The following is part of the Journal of Commerce's 2026 Annual Review and Outlook.

The big picture: A weakening US economy, depressed imports due to continued tariff uncertainty and plummeting spot rates in late 2025 will weigh heavily in favor of shippers during trans-Pacific service contract negotiations this spring.

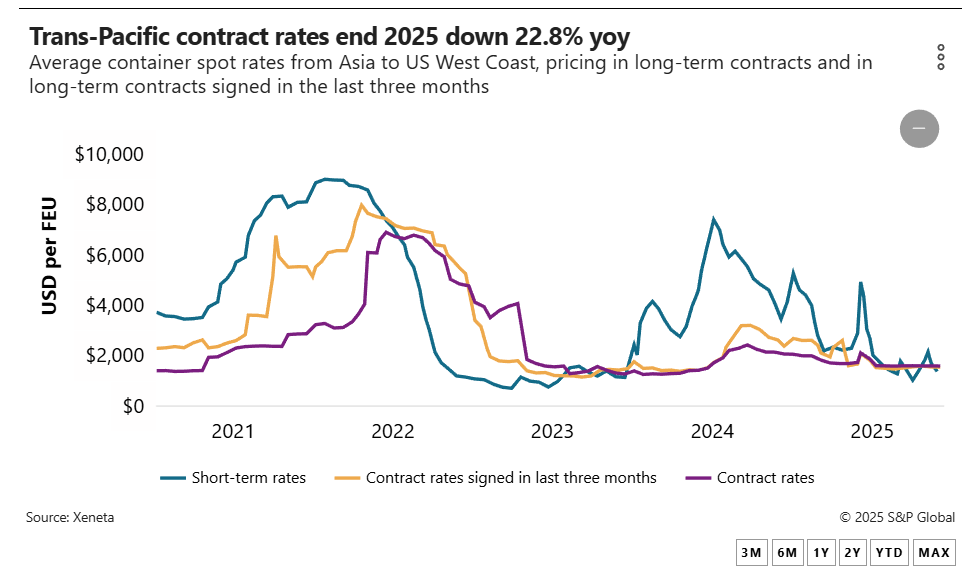

A look back: Midsize importers and their core carriers last spring signed 2025–26 service contracts with rates of about $2,000 per FEU from Asia to the US West Coast and $3,000 per FEU to the East Coast. Market conditions in the Asia-US trade in late 2024 and early 2025 — when the largest retailers typically begin their contract negotiations — were markedly different than today. Fueled by frontloading of seasonal merchandise to get ahead of higher tariffs threatened by the Trump administration, monthly US imports from Asia were increasing by an average of approximately 15% year over year, according to data from PIERS, a Journal of Commerce sister product within S&P Global. Average spot rates from Asia to the US West Coast eclipsed $5,000 per FEU in January, according to Platts, also part of S&P Global. In the environment of surging spot rates and tight vessel space, and with importers anticipating continued strength in imports in 2025 and prioritizing locking in guarantees of vessel space through their minimum quantity commitments (MQCs), carriers generally had the upper hand in pricing negotiations. The fixed rates in service contracts are normally lower than the spot rates for much of the year, but most carriers aim to fill at least half of their vessel space via MQCs from their largest customers. Service contract rates paid by midsize and smaller importers and by forwarders are generally several hundred dollars per FEU higher than those paid by the largest retailers.

A look ahead: Rates in 2026–27 service contracts, most of which will run from May 1, 2026, through April 30, 2027, will most likely be lower than in the previous contract, but how much lower remains to be seen. Outside of a brief fillip in June that coincided with a spike in spot rates, average pricing from Asia to the US West Coast in long-term contracts followed a downward trajectory all year, according to rate benchmarking platform Xeneta. Rising inflation, growing unemployment, weak consumer sentiment and persistent tariff uncertainty point to continued declines in US freight demand. And with vessel space abundant, importers will likely hold off on signing service contracts for as long as they can. Inventory replenishment after the Lunar New Year holiday in Asia, which begins Feb. 17, could boost volumes and help carriers keep spot rates from collapsing. But new, larger vessels that will be deployed in the trans-Pacific and the possibility of a return to the Suez Canal could add effective capacity to the trade, giving importers additional leverage in contract rate talks.

The next inflection: The strength of holiday retail sales in the final month of 2025 and inventory levels approaching the Lunar New Year factory shutdowns in February will be the major factors determining pricing power in trans-Pacific contract talks. If replenishment demand and spring volumes cause vessel space to tighten, importers could again prioritize MQCs rather than extracting the lowest possible price.