J.B. Hunt Transport Services said demand for its intermodal business remained soft in the third quarter, particularly on the West Coast, where transcontinental container loads fell 6% from a year earlier, as total rail shipments declined 1% overall.

In describing the overall freight market, the company remarked that“it's no secret, the market hasn't returned yet,”which has now surpassed three years.

The nation's largest domestic intermodal provider rolled out an early peak-season surcharge in July of $1,500 per container in Los Angeles, but the company later trimmed the fee to $800.

“We were disappointed in demand off the West Coast during the quarter and even adjusted our peak program in the middle of the quarter as an example,”said Darren Field, president of J.B. Hunt's intermodal division.“Demand for our domestic intermodal service wasn’t all that strong.”

Despite sluggish volume, executives said the peak season may not be finished because much of the cargo unloaded at West Coast ports this summer remains in local warehouses.

“It is important to disconnect the timing of peak season on the water from peak season of the inland supply chain,”said Spencer Frazier, executive vice president of sales and marketing.“Our conversations indicate there is a large amount of freight that was imported early that hasn’t moved through the inland supply chain yet. No one has canceled Christmas.”

There were some positive results despite the weaker third quarter in Southern California.

Domestic intermodal operating income rose 12% year over year, contributing to an 8% increase in company-wide operating income. The company said aggressive cost controls shaved $20 million in costs during the quarter.

East Coast intermodal doing better

Local East Coast intermodal volume climbed 6% in the quarter, a signal that there is strength on containerized freight staying within the CSX Transportation and Norfolk Southern Railway (NS) networks. The carrier credited improved rail service for helping to shift more truckload freight to rail in the region.

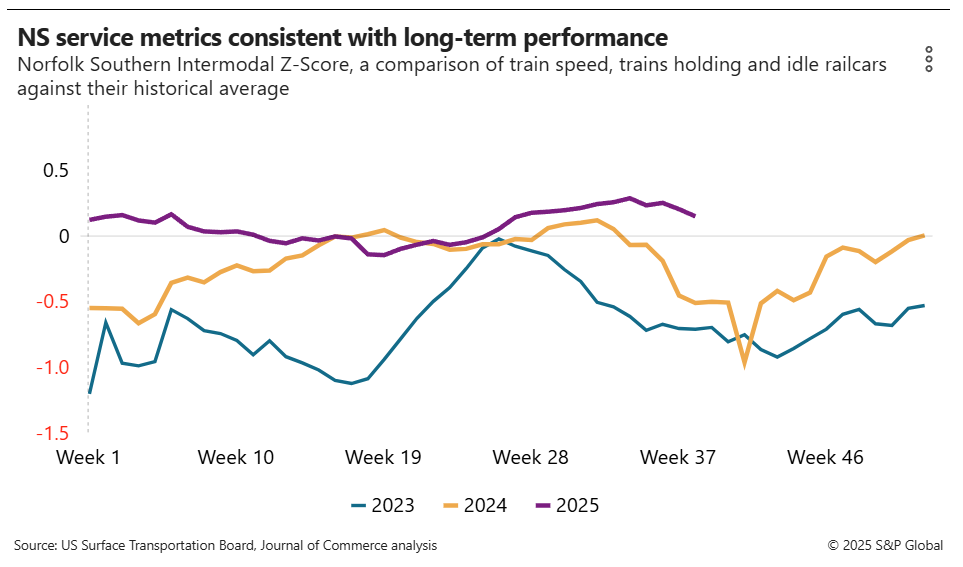

The Journal of Commerce Intermodal Service Z-Score, a measurement of how a railroad performs against its own history on three key service metrics, showed CSX and NS operated at or above average through the second-to-last week of the quarter. The final week's data is unavailable because the US Surface Transportation Board, which publishes the metrics, is affected by the federal government shutdown.

Norfolk Southern CEO Mark George said Thursday at the Virginia Maritime Association conference that intermodal train speeds are up this year.

“We're delivering consistent service, trending about 90% on-time performance,”George said.“In fact, in September, we had a standout month, hitting 100% in intermodal plan compliance.”

He added that international intermodal traffic has risen more than 3% year over year, while domestic volume has flatlined because of trade disruptions. The comments suggest either J.B. Hunt's East Coast gains may be concentrated on the CSX network, or other NS domestic intermodal partners have struggled to sustain shipments.

Not taking sides on UP-NS deal

J.B. Hunt CEO Shelley Simpson addressed Union Pacific Railroad's (UP's) proposed acquisition of NS before US regulators, signaling that the company would neither endorse nor oppose the transaction.

“Our decades of experience, including navigating seven prior Class I railroad mergers and our thoughtfully developed long-term agreements and strong relationships with NS, CSX, and BNSF should provide the basis for us to accept any changes in the industry,”she said Wednesday.

J.B. Hunt's Field pushed back on speculation that a merger would force J.B. Hunt to shift all East Coast traffic to CSX. The assumption stems from the carrier's long-standing partnership with BNSF Railway under the “Quantum Agreement,”a revenue-sharing arrangement formed more than 35 years ago that gives J.B. Hunt a pricing edge over competitors.

It also launched a Quantum service product two years ago with a 95% on-time intermodal performance guarantee supported by J.B. Hunt staff embedded at BNSF's headquarters in Texas.

In recent months, BNSF and CSX have deepened their relationship, launching coast-to-coast intermodal routes linking Southern California with Charlotte and Jacksonville. Other coast-to-coast routes to the Northeast may be announced next year after CSX begins double-stack intermodal service through Baltimore next spring.

This budding partnership has fueled speculation that J.B. Hunt could edge closer to CSX along with BNSF.

Many West Coast rail contracts include exclusivity clauses preventing companies such as Hub Group or Schneider National from using BNSF in markets where UP also runs. J.B. Hunt's BNSF deals carry similar restrictions, making it unlikely the carrier would be permitted to shift volume onto a merged UP-NS network in BNSF-served territories.

Even so, J.B. Hunt could continue using a combined UP-NS network for freight to stay east of the Mississippi, where BNSF has no presence.

“Any future merger that would be approved for whatever reason has been perceived that J.B. Hunt would have to move our traffic to CSX and that's not accurate at all,”Field said.“There's nothing about a future state new railroad that would mean our current Norfolk Southern footprint that we have today would be required to change.”