Freight imbalances and changes in capacity in certain lanes are tightening US truckload capacity, but not by much. Lower import volumes and a crackdown on illegal drivers have combined with seasonal peak demand to push spot pricing higher in some lanes, but most measures of dry-van truckload spot pricing have changed little since August.

Transactional truckload pricing is rising but“it's not a paradigm shift by any means,”said Paul Brashier, vice president of global supply chain for ITS Logistics.

“It's still a soft market, but we've seen cancellations increase and rates per mile nudge up,”Brashier said.“Is this something that changes the market post-peak? That's still to be determined.”

Over the course of 2025, several events, including the Fourth of July holiday and nationwide roadside truck and driver inspections, have led to short-term surges in spot truckload pricing, but rates have fallen back after those events. There's no clear evidence of either a demand catalyst or a supply chokepoint that would change that pattern.

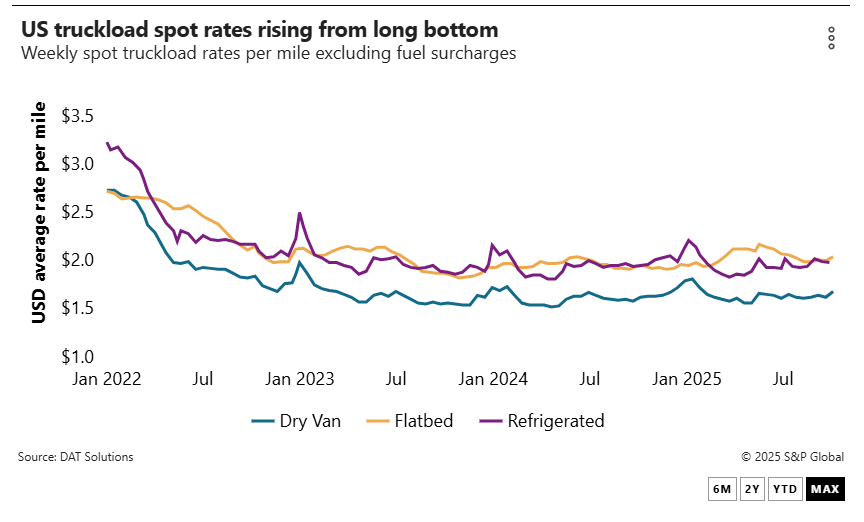

Truckload rates typically increase during the fourth-quarter peak. Last year, the US average dry-van rate from DAT Freight & Analytics rose from $1.61 per mile on Sept. 15 to $1.84 per mile on Jan. 5, 2025, before dropping back to $1.60 per mile by April 13. Indications are that spot rates are on a similar seasonal trajectory at the start of the fourth quarter.

The US average dry-van linehaul rate for the week ending Oct. 11 was $1.70 per mile, flat with the previous week and up 6 cents from a year ago, according to DAT Freight & Analytics. Dry-van rates at Truckstop.com were more volatile, with the US average falling more than 4 cents to $1.93 per mile after rising nearly 7 cents the previous week.

Other factors moving market

Truckload rates are inching upward despite weak demand, which suggests other factors are inflating rates, DAT Chief of Analytics Ken Adamo said in a statement.

“Freight imbalances and changes in available capacity drove rates higher in certain markets, as opposed to volumes,”Adamo said. Lower import volumes may be part of the mix.

The Cass Truckload Linehaul Index, a measure of pricing, rose 1.7% in September from August and was up 2.6% from a year earlier. The index is down 1% from two years ago, however. The US long-distance truckload producer price index in August was nearly flat year over year. The September report has been delayed by the US government shutdown.

Shippers contacted by the Journal of Commerce expect contract rates for 2025 to range from flat to higher by low single-digit percentages year over year. Similar to most analysts, they see little that would shift freight demand and truckload pricing into higher gear. Within trucking, there is continuous debate over what might be the next supply shock.

Predictions that the exit of thousands of small trucking firms would tighten capacity and flip the market have fallen flat. In 2025, more transportation analysts and trucking executives have talked about a developing“equilibrium”in the truckload market, a balance between supply and demand that could be upset by relatively small changes.

“We're setting up for increased vulnerability in the market next year,”David Spencer, vice president of market intelligence for Arrive Logistics, told the Journal of Commerce. “It's really next year when we start to see other forces [beyond seasonality] begin to have an impact,”he added, referring in part to a crackdown on drivers in the US illegally.

ELP impact

That crackdown on non-English-speaking truck drivers and those working in the US illegally with non-domiciled commercial driver's licenses (CDLs) is highlighted by nearly every analyst or executive speaking on the outlook for the trucking market. However, the impact of that crackdown, which began in June, on the overall market has been negligible.

As of Sept. 26, out-of-service (OOS) orders had been issued for 5,006 out of 12,055 violations issued to drivers year to date for failing to meet English-language proficiency (ELP) standards, according to the Federal Motor Carrier Safety Administration (FMCSA). In comparison, about 31,000 OOS orders were issued for driving without a valid CDL.

The total number of OOS orders issued during roadside inspections for all types of driver violations to date in 2025 is 202,257. State officials have issued 873,977 violations.

Since June, the FMCSA has viewed an ELP violation as an out-of-service violation, except for drivers operating within the commercial zone along the US-Mexico border. The Department of Transportation (DOT) has been investigating state issuance of non-domiciled CDLs and intensified a crackdown on those licenses in September.

Although estimates of the number of drivers who could be disqualified by the crackdown on licensing and English-language skills range as high as 200,000 or more, exact numbers for unqualified, illegal or non-English-speaking drivers are, not surprisingly, hard to come by. Enforcement to date has not had a direct impact on the overall market.

The crackdown may be having an impact in specific lanes, notably outbound lanes from Southern California and westbound lanes from crossing points along the US-Mexico border.

“You might be seeing an impact in some of the markets that have a higher propensity for non-domiciled drivers,” ITS' Brashier said, noting California in particular.

Brashier said ITS has seen capacity tighten in long-haul lanes — those more than 500 miles — while short-haul capacity has been more readily available. “We're having no problem [finding capacity] in intra-Texas lanes,”he said.

But that could reflect existing trends toward more regional freight, rather than a loss of non-domiciled CDL drivers.