Trans-Pacific container lines will accelerate blank sailings over the next four weeks in an effort to stabilize spot rates that are continuing to fall amid an unusually soft pre-Golden Week market.

The reduction in planned capacity for October has increased from 3.8% to 13.6% on the Asia-North America West Coast trade and from 4.8% to 14.4% on the Asia to East Coast lane, Alan Murphy, CEO of Sea-Intelligence Maritime Analysis, said in this week's Sunday Spotlight newsletter.

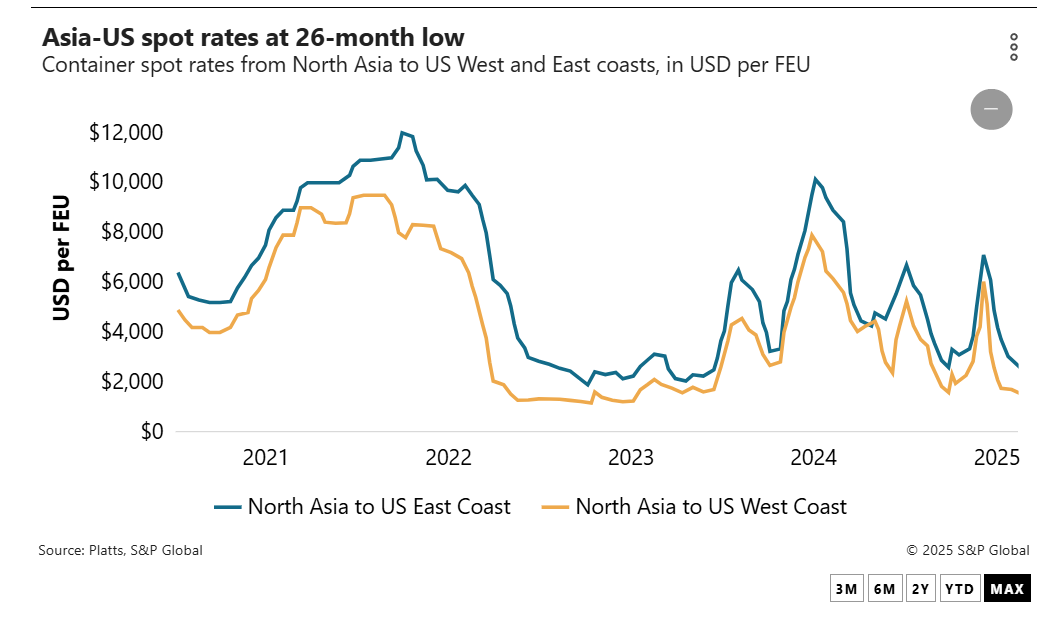

That comes as spot rates to the West Coast have fallen 30% over the past three weeks, with East Coast prices down almost 20%.

“The blanks won't increase the [spot] rates, they will just prevent a further freefall, and with all of the announced blank sailings, there will probably be some ad hoc blank sailings that haven't been announced yet,”Sanjay Tejwani, CEO of consulting firm 365 Logistics, told the Journal of Commerce.“We could still see more action.”

When compared with capacity reductions in recent years,“the current level of capacity reductions have fully met that threshold on Asia-North America East Coast ... while partially meeting that threshold on Asia-North America West Coast,”Murphy said.

Almost 17% of capacity from Asia into North America will be blanked in October, up from about 10% in September, according to maritime intelligence provider eeSea.

Spot rates from Asia to the West Coast had fallen to $1,400 per FEU as of Sept. 24, down from $2,025 on Sept. 5, according to Platts, a sister company of the Journal of Commerce within S&P Global. East Coast rates of $2,433 per FEU are down from $3,000 on Sept. 5.

Forwarders this week said some larger carriers have already begun to undercut those rates. One forwarder told the Journal of Commerce some larger lines are offering $1,350 per FEU to the West Coast and sub-$2,400 per FEU to the East Coast.

“Are we getting near the bottom? I would think so,”the forwarder said, adding those rates have been extended through Oct. 14.

“How much lower can they go? They've been going down on almost a daily basis,”said Chris Sur, executive vice president of ocean freight logistics at Unique Logistics International.

A carrier executive said some of the smaller lines are also contributing to the falling spot rates by offering sub-$1,400 rates to the West Coast.“They want to grab what cargo they can,”the source said.

Further capacity reductions in Q4?

Amid the current capacity reductions, Tejwani said the global idle fleet may begin to increase in the fourth quarter“now that there won't be much demand for the next three to four months.”

Forwarders and carriers anticipate a soft fourth quarter because the frontloading of peak season cargo prevented what is normally a busy September–October period in the trans-Pacific. Also, because Lunar New Year falls on Feb. 17, 2026, retailers are expected to shorten their inventory carrying period by waiting until January to ship their spring merchandise.

“[Carriers] continue to pull capacity out of this market and it won't be brought back into service,”Tejwani said.

The idle fleet is just 0.5% of total liner capacity, according to a Sept. 1 report from the maritime intelligence company AXS Marine, which owns Alphaliner.

Midsize retailers have access now to spot rates that are lower than the fixed rates they signed for in their 2025–26 service contracts in May. The service contract rates for midsize shippers approached $2,000 per FEU to the West Coast and about $1,000 per FEU higher to the East Coast.

The breakeven rate in terms of covering carriers'fixed costs varies from carrier to carrier based on their operating efficiency and the size of the vessels they deploy, but at the current spot rate levels, some lines may not be covering their fixed costs.

“At $1,350, some may already be there,”said the forwarder source.

Sur said how carriers respond to the Golden Week factory closures in Asia will be crucial in their attempt to find a bottom for spot rates.

“I think [spot rates] have gone low enough,”he said.