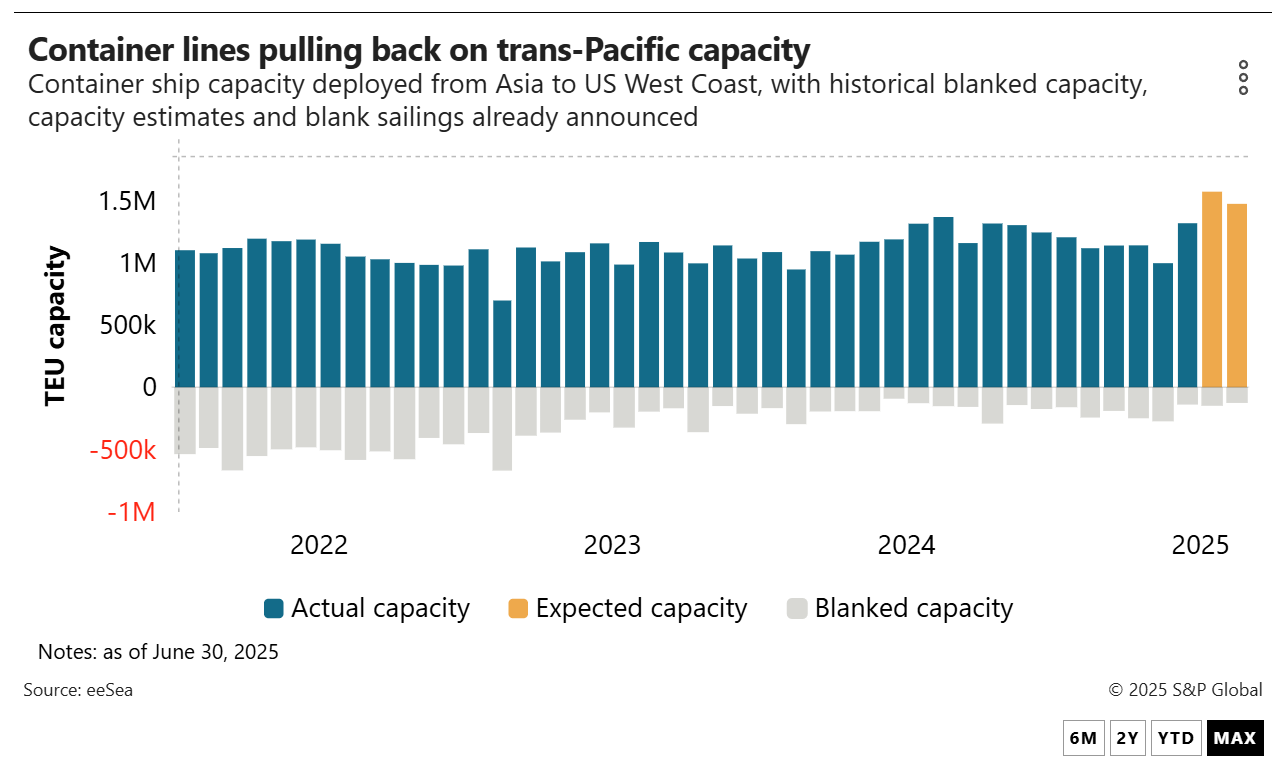

Container lines are pulling back on the deployment of tonnage from Asia to the US in August in the latest course correction linked to stop-and-start import demand amid tariff uncertainty.

Container lines are set to deploy 6.2% less tonnage from Asia to the US West Coast in August than in July, equating to 90,000 TEUs of capacity, according to maritime intelligence provider eeSea. Comparatively, ocean capacity from Asia to US East and Gulf coasts will be trimmed by just 1.7%.

Mediterranean Shipping Co. this week suspended its Pearl service to Long Beach, with the last sailing out of Xiamen on July 13, according to Kuehne + Nagel's SeaExplorer tool. Container lines can also blank sailings — removing ships from services or skipping ports — to further calibrate capacity to weakening demand.

The rate of blanking compared with deployed capacity in May reached 26%, equating to 262,000 TEUs, as carriers adjusted networks, according to eeSea. In June, the rate was 9.5%.

Tariff whiplash

Carriers began pushing capacity back into the trade in May in anticipation of a surge of imports from China, driven by an early peak season caused in large part by the 90-day reprieve on higher US tariffs. Just a month earlier, US importers canceled China bookings after President Donald Trump on April 9 imposed 145% tariffs. In response, ocean carriers blanked sailings and suspended services, although Trump soon reversed course.

Now carriers face an expanding capacity overhang amid downbeat retail import forecasts and the surge in US imports linked to the initial tariff reprieve in its last gasp. The tentative agreement with China to bring US tariffs to 55% hasn’t had much impact on importers' peak season ordering, thanks to more than eight months of frontloading shipments and a narrow window for getting goods in before the year-end shopping season.

While US retailers upgraded their import forecast slightly in early June, their volume expectations still lag the same period in 2024. US imports are expected to reach 2.13 million TEUs this month, down from 2.32 million TEUs a year ago, according to the Global Port Tracker. Retailers plan to bring in 14.7% less volume, equating to 331,000 TEUs of capacity, next month compared with August 2024.

US laden imports from Asia have been falling since September, with the exception of a short-lived recovery in April, according to PIERS, a sister product of the Journal of Commerce within S&P Global. In September, inbound volumes hit 1.79 million TEUs, falling to 1.4 million TEUs by May.

Container spot rates from Asia to the US, a barometer of how capacity is matching up to demand, have been falling for a month, according to various indexes. For example, container spot rates from Shanghai to the US West Coast last week were less than half the price a month ago, at $2,089 per FEU, according to the Shanghai Containerized Freight Index.