Strong demand on Asia-Europe continues to hold up short-term rates that are being further supported by ocean carriers shifting capacity from the trade to the trans-Pacific following the US' May 12 pause on sky-high China tariffs.

But all eyes are on another date — July 9, the end of the 90-day pause on the so-called reciprocal tariffs the Trump administration levied on its non-China trading partners. Forwarders believe what happens after that will determine the level of demand on Asia-Europe routes in the second half of the year.

Burkhard Eling, CEO of German forwarder Dachser, said shippers and forwarders were struggling to forecast demand for the rest of the year with the tariffs impacting trade lanes outside the trans-Pacific.

“It all depends on what will happen on July 9,” Eling told the Journal of Commerce in an interview.“Everyone is preparing for this date and that will affect a lot of shipments in the second half, but predicting what will happen is nearly impossible.”

A Hapag-Lloyd spokesperson said the peak season has already started on Asia-Europe, with solid demand on the westbound trade lane. The peak shipping period on the trade typically runs from June to China's “Golden Week” in the first week of October.

“Demand is stronger on the Med trades, as capacity has been pulled out by the competition,”the spokesperson told the Journal of Commerce Tuesday. But he conceded that forward visibility was challenging because of the unpredictability in the market.

Eling also cited the uncertainty moving forward.

“If somebody says he knows there will be a peak season, I would love to have his crystal ball,”he said. “I wouldn't say the classic seasonality is gone, but with all the tariffs and the complications, I don’t expect a big season in the second half.”

Record capacity to be deployed in July

The latest Asia-to-Europe volume data from Container Trades Statistics (CTS) is for April, when 1.64 million TEUs were transported westward, an increase of 8.6% year over year and a 6% gain from March.

When the North Europe and Mediterranean destinations are separated, Asia-North Europe volume rose 6.6% year over year in April to 1 million TEUs, while Asia-Mediterranean volume was up 11.1% at 641,690 TEUs.

In the first four months of 2025, total Asia-Europe volume was up 9% year over year at 6.13 million TEUs, with the Asia-North Europe segment rising 6.6% to 3.72 million TEUs and Asia-Mediterranean surging 12.14% to 2.4 million TEUs, according to CTS.

Data from rate benchmarking platform Xeneta shows the four-week rolling average capacity offered on Asia-Europe reached a record 346,000 TEUs on June 5, higher than at any point during the pandemic.

“But as the extra loaders that brought an all-time high level of capacity to the Asia-North Europe trade are now needed back on the trans-Pacific, the short-term contracts are rising in early and mid-June,”Peter Sand, chief analyst at Xeneta, told the Journal of Commerce Tuesday.

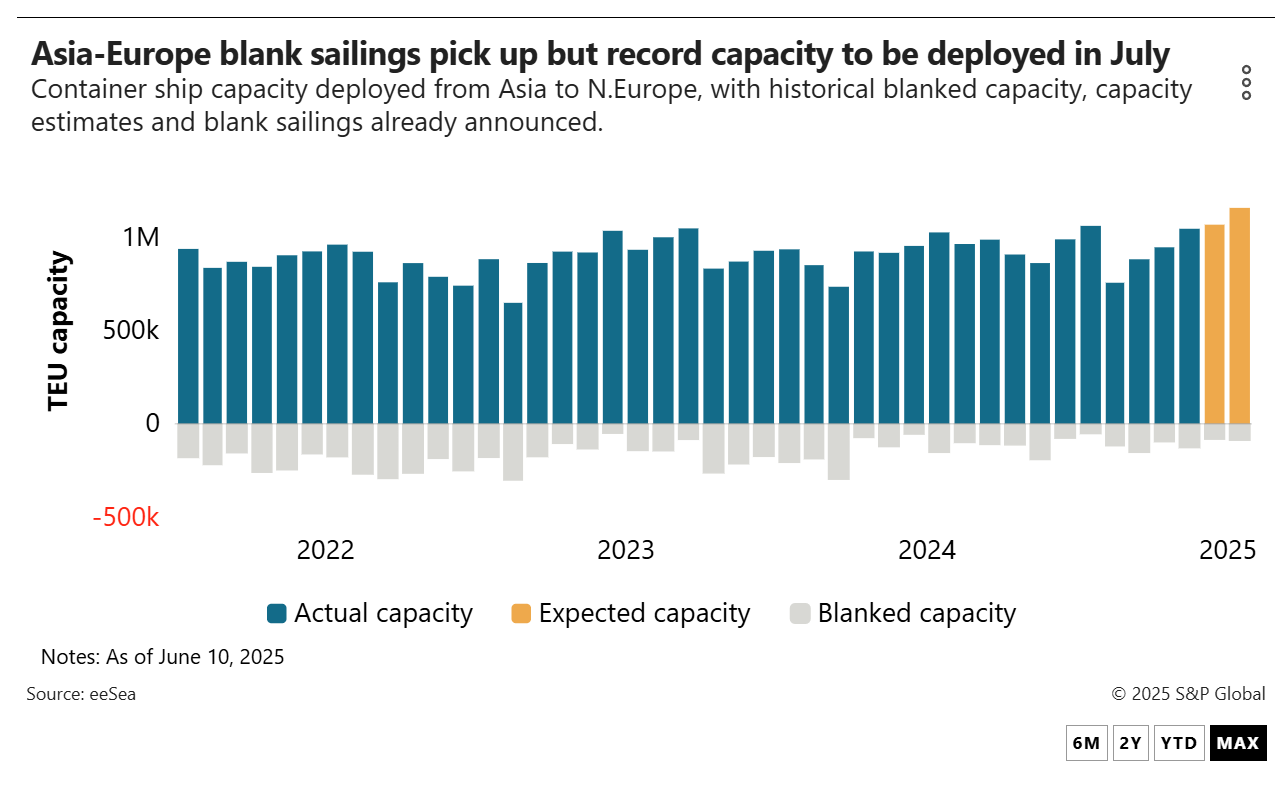

Blank sailings are also increasing on Asia-Europe, with data from visibility provider eeSea showing 86,241 TEUs will be cut in July, up from 80,000 TEUs in June. But at the same time, a record 1.15 million TEUs in capacity will be deployed in July.

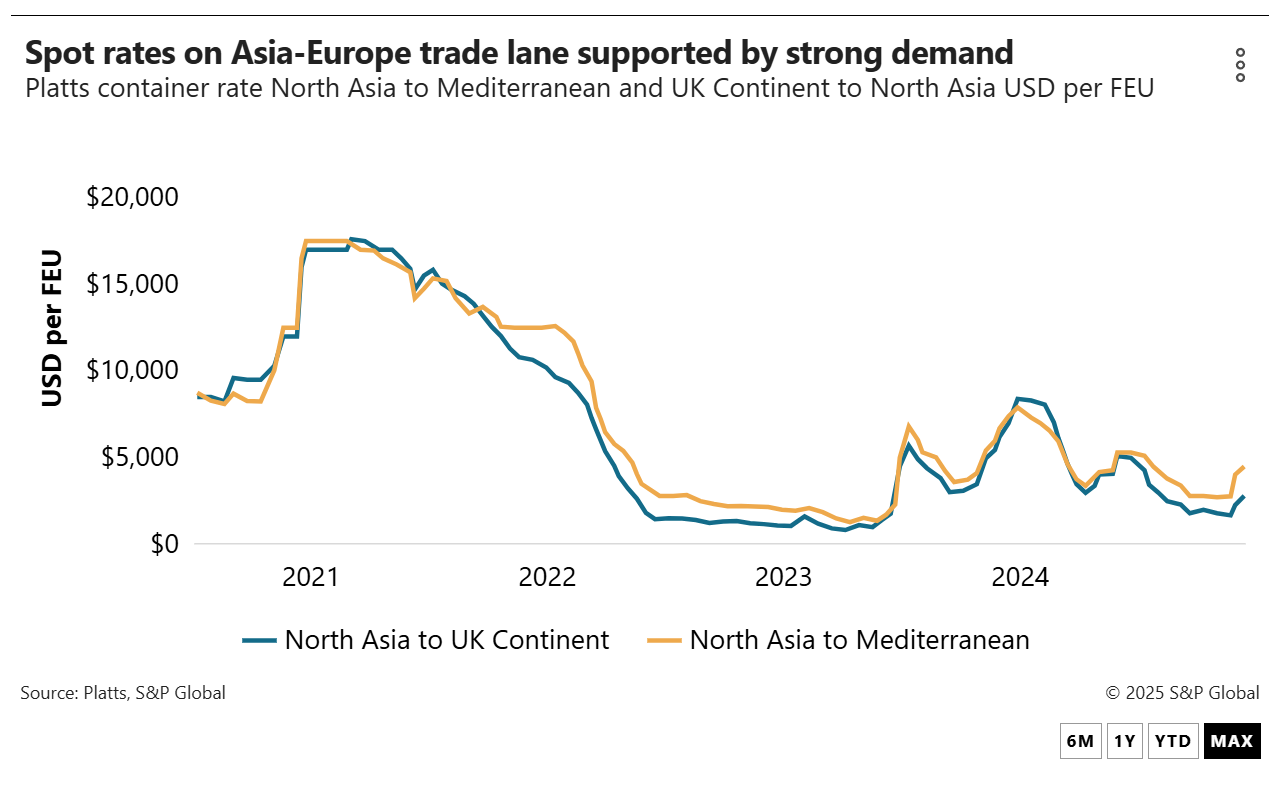

Despite being awash with capacity, rates are staying aloft because of the robust demand combined with ships exiting to the trans-Pacific and capacity still being absorbed by the ongoing diversions around southern Africa.

Spot rates from Asia to North Europe this week rose to $2,800 per FEU, up almost 15% from the previous week, according to Platts, a sister company of the Journal of Commerce within S&P Global. Asia-Mediterranean rates were up 3.7% at $4,500/FEU.

Xeneta's index has the Asia-North Europe rates flat at $2,419/FEU this week, while Drewry's World Container Index shows rates from Shanghai to Rotterdam up 32% on the previous week and Shanghai-Genoa rates up 38%.

“A lot of carriers are moving their tonnage back to the trans-Pacific trade and the overcapacity we had is diminishing while booking strength is increasing,”said Tom Turner, head of ocean for Europe, the Middle East and Africa at Toll Group.

Confident carriers raising rates

The supply-demand dynamics are giving carriers the confidence to introduce rate increases to the market, Turner noted. Following the June 1 freight-all-kinds (FAK) increases that led to a sharp rise in rates, some ocean carriers have announced rate hikes and peak season surcharges for June 15.

“The carriers might be overly ambitious and shooting a bit higher than what they're realistically hoping to achieve, but at the same time, I wouldn't feel comfortable advising a customer that the rates are going to go down,”Turner said.

“We are in a tight enough market to say that the carriers will be able to defend some of the increases,”he added.

Matthias Hansen, senior vice president of global ocean freight at France-based forwarder Geodis, also pointed to carriers shifting tonnage back to the trans-Pacific to take advantage of the high rates from China to the US.

“There is something like 28 extra loaders moving out of Asia-Europe and I expect a shortage of equipment will emerge because there is such a big pull towards the US,”he told the Journal of Commerce.

Hansen said although he was surprised at the strength of the Asia-Europe demand, he expects the strong volume will continue for“at least another two to three months.”

Eling attributed part of the current rising demand to the fact that when the US imposed 145% tariffs on China and shippers paused orders, Chinese producers quickly looked for new markets and Asia-Europe was the biggest one. That led to rising demand on the trade that continued even after the mid-May pause.

“When you consider [145%] tariffs from the US, Chinese producers need to find different markets to place their goods, and of course, Europe is a big market,”he said.“This is the natural consequence of the tariffs that we are seeing in the demand.”