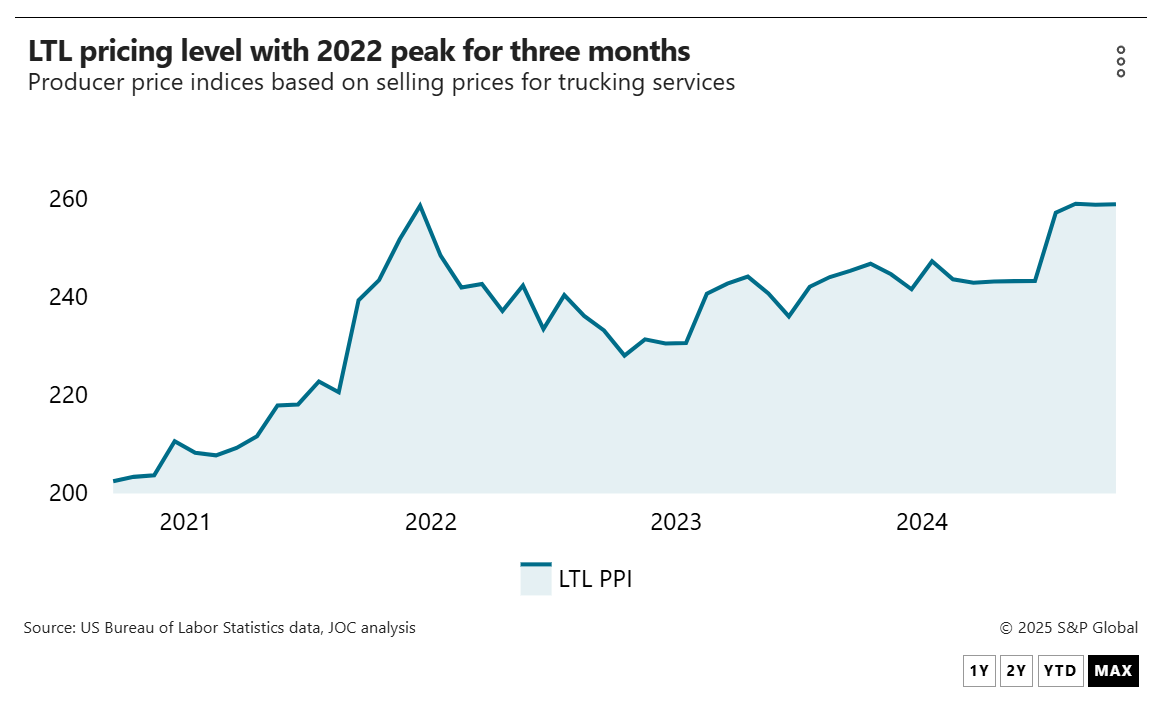

US less-than-truckload (LTL) pricing has flatlined, but at the highest point on record, according to the US Bureau of Labor Statistics (BLS).

The current BLS long-distance LTL producer price index (PPI) of 259 has remained stable from February through April, level with its previous pandemic-era peak in June 2022.

The BLS uses pricing data from December 2003 as its base (100) for calculating the LTL and truckload PPIs.

The April reading is 4.9% higher than a year ago and 12.1% higher than July 2023, when the collapse of Yellow into bankruptcy set LTL costs climbing for the next 22 months.

The LTL PPI is a measure of the total“selling price”LTL customers pay carriers for services, including accessorial fees and fuel surcharges as well as base LTL trucking rates. It is a metric tracking the total cost of LTL services to shippers, rather than base rates.

The LTL PPI flatlined from September through December 2024 before jumping 5.8% from December to January and climbing another 0.8% in February to its current plateau.

The jump in early 2025 most likely corresponds with new rates set by contract renewals. The PPI corresponds closely with contractual rate increases reported by LTL carriers in recent first-quarter earnings reports and in interviews with the Journal of Commerce.

Most carriers reported annualized rate increases in the mid-single-digit percentage range in the first quarter. New contract agreements are still coming into effect.

To date, tariff-related variations in demand have had little effect on the US LTL market.

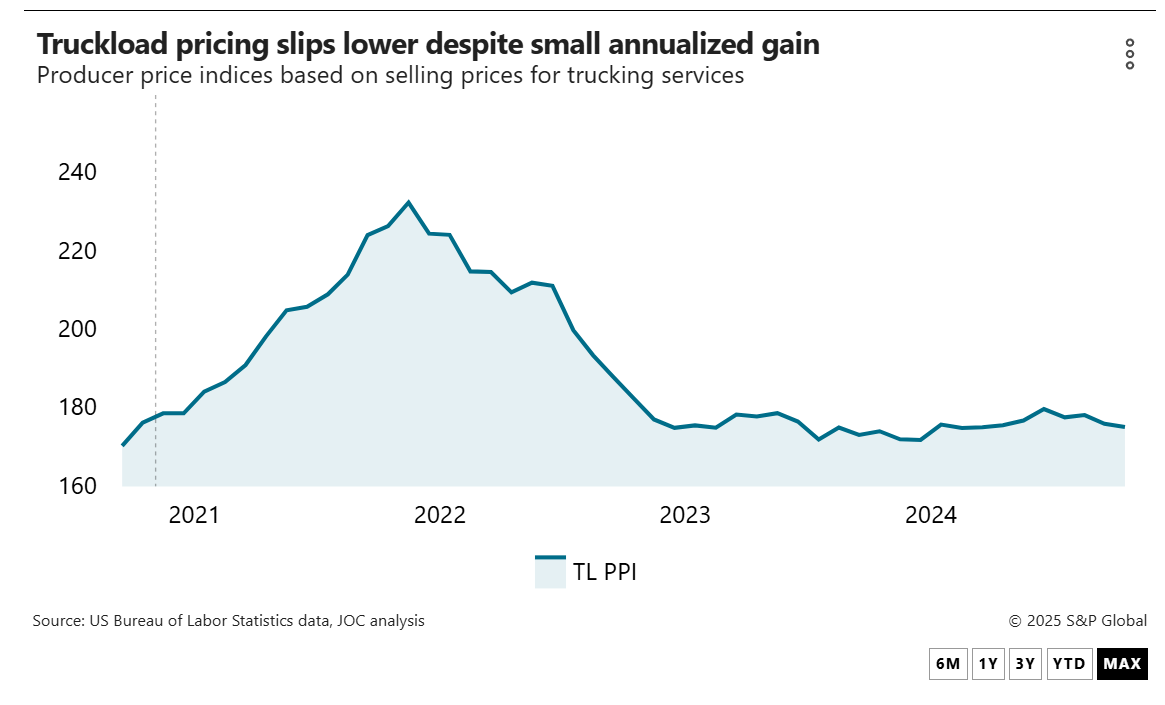

The rebound in LTL pricing stands in contrast to the performance of the truckload sector, where pricing is still close to the bottom of a trough first entered in June 2023.

The BLS long-distance truckload PPI of 175.2 fell just less than 1 percentage point in April and is down 2.6% from January and 24.6% from its pandemic-era peak in May 2022.

The basic explanation for the LTL/truckload divergence is capacity. The loss of Yellow put more than 300 LTL terminals on the market; not all of them have been sold or returned to service.

The LTL sector as a whole added only 83 terminals in 2024, bringing its total to 3,216 facilities, according to SJ Consulting Group. That is a 2.7% gain over 2023.

The truckload sector still has excess capacity, with about 37% more carriers with active operating authorities than in 2019, data from the Federal Motor Carrier Safety Administration shows.