Major container lines are seeking spot rates on service from China to the US West Coast that are more than double the current level as they look to capitalize on an anticipated surge of volume triggered by a 90-day pause in the steepest US tariffs.

Container spot rates are already spiking following the Monday announcement, and if carriers are successful in imposing a combination of general rate increases (GRIs) and peak season surcharges (PSSs) set to take effect June 1, pricing would jump to approximately $6,000 per FEU to the West Coast and $7,000 per FEU to the East Coast. GRIs apply to all shippers regardless of size, while PSSs are only imposed on smaller shippers that don't have agreements with carriers prohibiting their use.

Momentum appears to be on the carriers'side. Hapag-Lloyd said it has seen a 50% increase in bookings from China to the US this week, while forwarders have reported jumps as high as 100%. Given the short window of the agreement, and the need to ship fall and holiday merchandise before tariffs may increase if the deal falls apart, forwarders report that bookings are soaring.

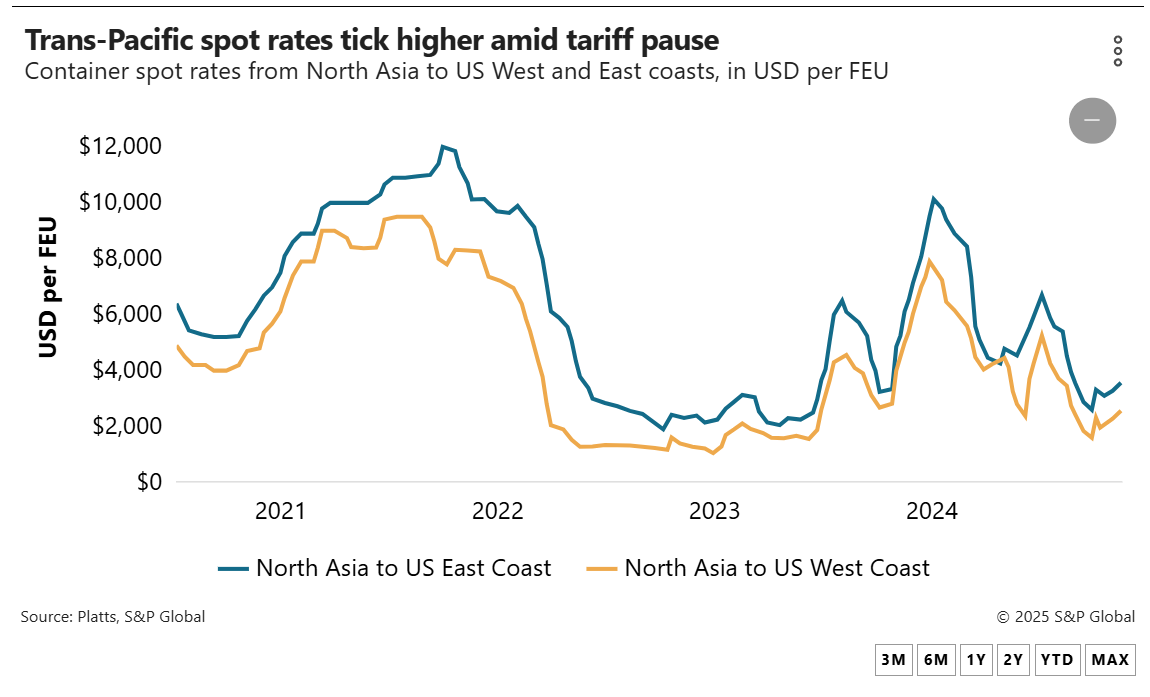

“It's shades of 2024,”Benton Kauffman, head of trans-Pacific air and sea logistics at forwarder DSV, told the Journal of Commerce, referring to last summer, when container spot rates jumped to upward of $8,000 per FEU to the West Coast during acrimonious dockworker contract negotiations on the East and Gulf coasts.

As of Wednesday, average spot rates from Asia to the West Coast rose to $2,567 per FEU, up from $1,600 per FEU at the end of March, while Asia-East Coast pricing rose to $3,567 per FEU from $2,600 per FEU during the same period, according to Platts, a sister product of the Journal of Commerce within S&P Global. Last year, spot rates peaked at $8,133 per FEU to the West Coast and $10,133 per FEU to the East Coast in the week of July 5.

Carriers Hapag-Lloyd, Mediterranean Shipping Co., CMA CGM, Ocean Network Express (ONE) and Zim Integrated Shipping have filed spot rates of $6,000 per FEU starting June 1. Another round of increases is poised for June 15, with Hapag-Lloyd, MSC and CMA CGM set to increase rates to $8,000 per FEU, according to rate notices from the carriers.

“Of course, these are just their filings,”noted a forwarder who asked not to be identified.“We will see what levels they really pass on once we get to these dates.”

Bookings from China surge

The carrier rate increases appear to be supported by a spike in bookings since the US and China announced an agreement that reduced US tariffs on Chinese goods from 145% to 30% for at least the next 90 days.

“There's definitely been a ramp up in orders during this 90-day window,”said Robert Khachatryan, CEO of forwarder Freight Right Global Logistics.

Khachatryan explained that importers appear to be in a rush to get their shipments into the US while the 30% tariff on China is in effect. They are concerned that after 90 days, if a permanent agreement is not reached, the tariffs could shoot back up.

“Everyone seems to be concerned with the 90-day window,”Khachatryan said.

Revelyst, an importer of outdoor apparel, paused its purchase orders with factories in China in April, said John Pace, senior manager of global logistics. Now, the company is prioritizing those shipments that are ready to move, to be followed by shipments that will depart in the coming weeks as factories ramp up production.

A carrier executive who asked not to be identified told the Journal of Commerce that factories in China should be able to quickly increase production as most vendors paused or slowed down production after the 145% duty went into effect in early April, rather than completely shutting down and laying off staff. Similar to Khachatryan, the carrier executive said importers are frontloading as much merchandise as they can.

“They have to ship now in case there is another tariff increase in August,”the source said.

However, forwarders and importers say the huge increases in spot rates and surcharges that carriers announced over the past few days would put a large dent in the savings they had anticipated from the tariff cuts.

“We are being careful,”Pace said.“Shipping rates are certainly a factor in our decisions.”