Large US truckload carriers are cutting even more capacity from their truck fleets, trying to reach a balance with demand that stubbornly keeps slipping lower. At the same time, at least one indicator shows the number of active truck fleets is once again rising.

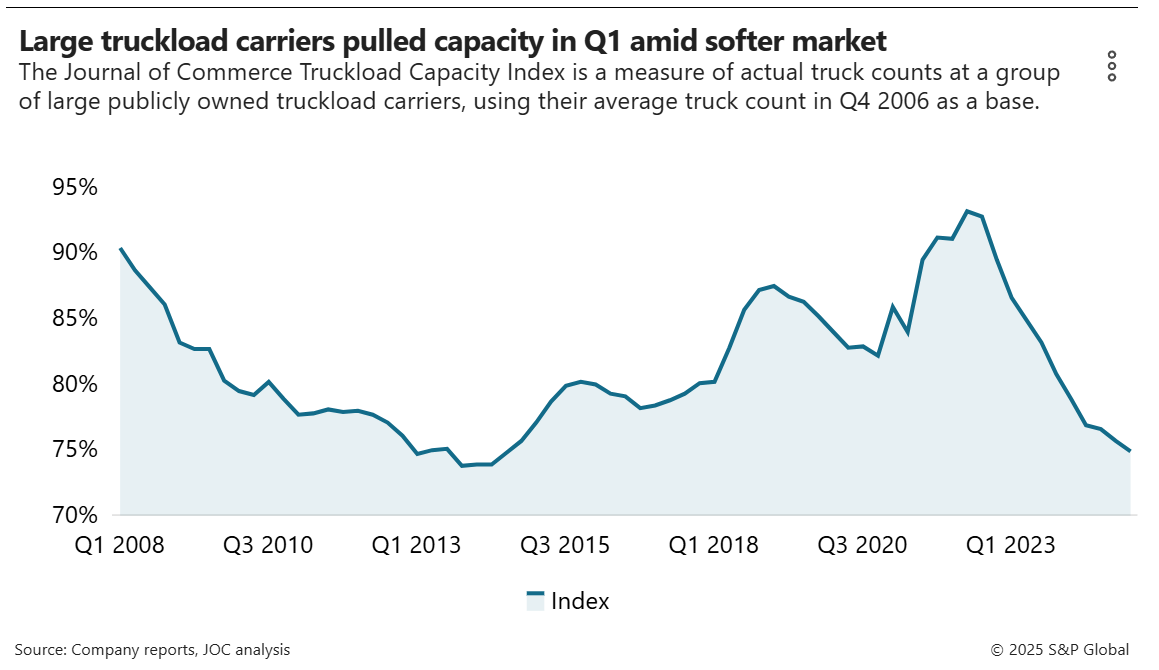

Trucking companies that promised to cull more trucks kept their pledge, driving the Truckload Capacity Index (TCI) published quarterly by the Journal of Commerce down 0.8 percentage point to 74.9% in the first quarter.

The TCI index, which reflects actual truck counts at large publicly owned carriers, has dropped 18.3 percentage points from its mid-2022 peak and hasn't been this low since the third quarter of 2014. The index is based on a truck count from the 2006 fourth quarter.

“Market conditions continue to favor the shipper amidst choppy conditions in the industrial economy,”Frank Lonegro, CEO of Landstar System, told Wall Street analysts during an earnings call Tuesday. “Truck capacity continues to be readily available.”

Landstar in the first quarter reduced its truck fleet by 2.5% from the previous quarter and 8.4% year over year. The TCI index dropped 1% sequentially and 5.1% on an annualized basis in the same period. Landstar is one of the carriers included in the index group.

“The first quarter is historically the most challenging quarter from a net truck count standpoint,”Lonegro said.“It is typical to incur turnover in BCO [business capacity owner or owner-operator] truck count in a low rate per load environment.”

Incoming capacity

But Landstar continues to add trucks as well, which underscores that truck capacity shouldn't be viewed just through black and white, up and down lenses.“In the fourth quarter, we added 500 trucks, but we lost 700 trucks,”Lonegro said.

“The fact that new folks are coming to us tells us that the model is quite sound and quite resilient,”he said. And new folks are coming into trucking, despite soft demand and low carrier pricing, and drawn perhaps by the prospect of pulled-forward US imports.

More carriers with active operating authorities entered trucking than left the business in April, with new carrier authorities jumping 48% from March, Federal Motor Carrier Safety Administration data shows. The net number of new authorities in April was 558 carriers.

“That doesn’t sound like much, but it’s the highest number we've had since 2022,”said Avery Vise, vice president for trucking at FTR Transportation Intelligence. April was only the fourth period in the past 31 months when there's been net positive growth, he said.

Dean Croke, principal analyst at DAT Freight & Analytics, sees a surge in spot market demand in the actual number of loads moved in recent months — a metric he said has increased 17% from February through May, coinciding with pulled-forward freight.

As a metric, loads posted are used more often to track volumes and load availability than loads moved or completed transactions, but loads may be posted multiple times on several load boards. That has the potential to obscure or distort underlying trends.