Spot rates in the eastbound trans-Pacific are on a rapid rise as stakeholders on the trade lane expect a significant increase in cargo on the water in the wake of the preliminary tariff deal agreed to last weekend between the US and China.

While various pricing indexes have yet to reflect the post-deal jump in rates, forwarder sources say they are seeing May 15 general rate increases (GRIs) of about $1,000 for both the US West and East coasts, with an expected crunch in vessel capacity and the potential for port congestion driving the gains.

“We know that a lot of capacity has come out and there's going to be a tremendous amount of volume that has to move,”said Rachel Shames, vice president of procurement and pricing at CV International.“No one knows how much, but we know it's going to strain the system. The question is: How high will rates go?”

In addition to the $1,000 GRIs carriers are due to implement this week, sources say an additional hike of $1,000 to $3,000 per FEU could be on tap for June 1. And several forwarders who spoke to the Journal of Commerce said shippers already need to book at $6,000 per FEU or above to guarantee space.

In a research note Wednesday, analysts at Jefferies said Asia-West Coast spot rates are now being quoted at $3,000 per FEU, with East Coast rates at $4,000/FEU. Just how far rates could rise depends in large part on volumes, as not all observers are ready to categorize the coming flush of imports as a sustained surge.

“It is too early to gauge whether this week's volume surge is a simple return of normal volumes, a pull forward of demand, or an early start to peak season,”Jefferies said.“As of now though, spot rates are likely to continue gaining given limited vessel capacity near term.”

Platts, a sister company of the Journal of Commerce within S&P Global, shows North Asia to West Coast rates at $2,500 per FEU as of Wednesday, up $700 from a month ago. East Coast rates were at $3,500/FEU, up $500 month over month. But in the early days of a rapidly moving market, pricing indexes have yet to catch up to actual rate levels.

A source at a non-vessel-operating common carrier (NVO) said he is rescinding quotes made to clients in April, unable to honor the initial offers in the new market environment. That same source saw bookings increase by about 200% this week.

Carrier moves

An unbalanced supply and demand dynamic is fostering a hospitable environment for the rate hikes after carriers reduced capacity on the trans-Pacific in response to canceled bookings out of China in April in the aftermath of the US tariffs slapped on Beijing.

On Wednesday, Hapag-Lloyd reported an increase of more than 50% in China-US bookings since the preliminary trade deal was signed over the weekend, also noting double-digit increases compared with pre-tariff cargo volumes — likely exacerbated by cargo held in China since early April.

CEO Rolf Habben Jensen said the carrier expects“a surge in volume in the upcoming 60 or 90 days.”

“But beyond that it is very difficult to predict and will depend on what kind of [trade] agreements will be closed between the US and other countries,”he said.

Hapag-Lloyd and Gemini Cooperation partner Maersk each said they had swapped out large vessels for smaller ships on the eastbound trans-Pacific due to the decreased volumes but will reinstate the larger vessels now that demand has rebounded.

“Over the next 90 days, there's clearly going to be pent up supply that sits in China that needs to be reintroduced to the supply chain and [be brought to the US],”Charles van der Steene, president of Maersk North America, told CNBC.“To bring capacity back in for vessels that have been redeployed elsewhere will be more difficult.”

While the most prominent carriers operating on the trade lane are working to undo capacity reductions, several forwarder and shipper sources expect opportunistic behavior from some of the more agile carriers.

“Big carriers, which reasonably anticipated continued import reductions and announced repositions [and] service suspensions ... will need to reverse course to take advantage of the coming import demand,” Peter Friedmann, executive director of the Agriculture Transportation Coalition, told the Journal of Commerce. “Some of the smaller, nimble carriers that jumped in during the COVID crisis will jump in now.”

Added concerns

As bookings climb and the market faces an increasingly significant capacity imbalance, stakeholders are concerned about the longer-term impacts of the changes, such as port congestion, equipment availability and manufacturing delays.

Forwarder sources say West Coast ports will be particularly appealing for shippers due to the lower transit times from Asia and the uncertainty around what will happen after the 90-day cooling off period between Washington and Beijing ends.

“It's all about when you can clear customs, and obviously that is much faster on the West Coast because the ships arrive much earlier,”said Stephen Nothdurft, vice president of North American sales at forwarder MOL Consolidation Service.“You can get three ships cleared [if you ship to the] West Coast before one even gets to the East Coast. I don't know that people are abandoning the East Coast loaders, per se, but having cargo on the shortest transit possible [is important to importers].”

And while orders are increasing, manufacturing delays as some factories in China ramp back up to full speed could slow some US importers down, causing concerns within the 90-day deadline to take advantage of the reduced tariffs.

Several importers reported factory closures in China as demand waned, and manufacturers will likely need some runway to reach traditional output levels. Forwarder and shipper sources are reporting some manufacturing delays of several weeks to a month.

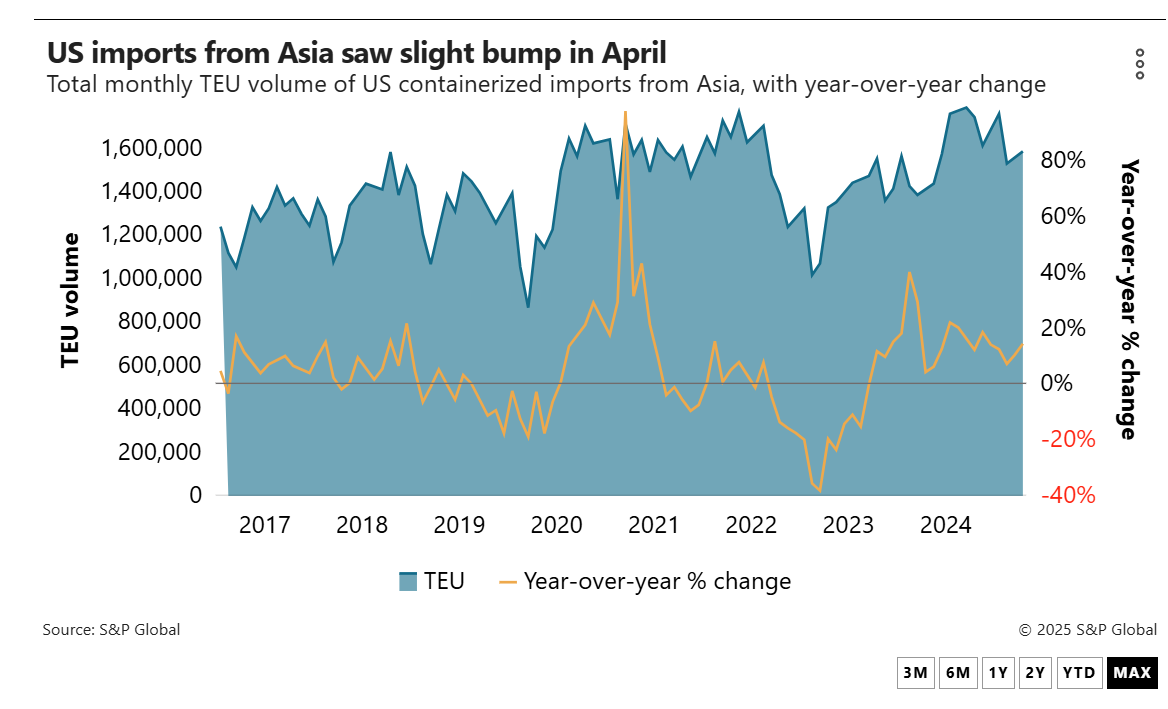

Meanwhile, fresh data from PIERS, a sister product of the Journal of Commerce within S&P Global, shows that US imports from Asia and China specifically rose in April, likely reflecting the last rush of boats on the water ahead of the April 9 implementation of new tariffs.

US imports from Asia last month rose to 1.59 million TEUs, up 3.9% from 1.53 million TEUs in March and up 14.5% from April 2024. US imports from China were at 849,390 TEUs, up 5.8% from 802,570 TEUs in March and 12.3% higher than a year ago.