The eastbound trans-Pacific will likely face insufficient ocean capacity to handle a surge of unlocked shipments from China to the US following the preliminary trade deal announced Monday, resulting in higher spot rates, surcharges and shortages of vessel space and equipment in the coming weeks, forwarders warned.

“It's clear it will be a mad rush to get capacity,”Jason Cook, managing director at Ardent Global Logistics, said.“Customers were already prebooking Friday and [early Monday]. Every day will count this week towards getting the booking plan and anticipated allocations with carriers.”

Nerijus Poskus, Flexport's head of ocean procurement, said:“I think we're going to have a very significant peak season.”

With just over a month having elapsed since the Trump administration slapped 145% tariffs on Beijing, a significant backlog of goods has built up in China, reflected in volumes dropping about 30% in recent weeks, according to Hapag-Lloyd and others.

“For the first three weeks of May, 34% of capacity in the trans-Pacific has been taken out through blank sailings and service removals,”Poskus said.

Now, much of that volume will come flooding back into the market with the US and China agreeing during weekend talks in Geneva to slash their respective tariffs for 90 days while negotiations continue. The 145% US tariffs will be cut to 30%, while China's reciprocal 125% tariff on US goods will be lowered to 10%.

Those levels are clearly low enough to unleash much of the pent-up demand building over the past month. Indeed, container bookings for imports from China appear to have been strengthening even before the tariff announcement. Bookings jumped 29% last week compared with the week prior, according to maritime visibility provider Vizion and data and analytics company Dun & Bradstreet

“Currently, ships are sailing 85% to 90% full, yet there is a huge backlog and that backlog at some point needs to be shipped,”Poskus said.“So if demand increases more than 10% — and it will — and if carriers put back 10% of capacity, we are at 100%. In other words, full. No space. And carriers have to add capacity such as extra loaders in order for importers to have space.”

A space crunch will rapidly develop on the trans-Pacific, as the ships needed to replenish capacity aren't immediately available, Poskus said.

“The issue is a lot of these ships have been deployed on other trade lanes — intra-Asia, Asia to Latin America, etc. They are not just sitting and waiting, so shifting back capacity to the [trans-Pacific] will be not as easy as it seems and will take time,”he said.“There is maybe a ship or two that can be deployed back right away but as for the market as a whole, it will take more than four weeks for any meaningful capacity to be injected back into the TP [trans-Pacific].”

Ocean rapidly withdrew capacity and redeployed it to multiple other trade lanes including Asia-Europe, DHL Global Forwarding told customers in its most recent Ocean Freight Market Update. The forwarder warned of“significant equipment and capacity constraints that could lead to increasing rates”in the aftermath of a deal between the US and China.

Patrick Fay, CEO and co-founder of forwarder BOC International, said China bookings began surging on Sunday when the US signaled that a deal had been reached even before the specifics on tariff cuts were disclosed.

“It is going to take a while to get these blank sailings canceled,”he said.“It will be very tight the next three weeks.”

Port capacity could be overwhelmed

Even before Monday's announcement, others agreed that a volume surge would develop quickly after any trade deal reached between China and the US.

“If a de-escalation was to happen, it is not unlikely that there would be a catch-up effect where, at some point, the situation resolves itself, and then you see a much stronger demand coming out of China,”Maersk CEO Vincent Clerc said on the company's May 8 earning call.

And any surge will potentially overwhelm US port capacity given that, as carrier executives told the recent Georgia Foreign Trade Conference, the system has no greater ability to absorb surge volumes than it did back in 2020.

“Right now ... volumes are down [30%-40%] and if that goes up, the sheer surge will test the system and disruption cannot be avoided,”said Charles van der Steene, president of Maersk North America.

Other issues will further complicate the post-deal market, empty containers among them, Poskus said.

“Carriers have repositioned a lot of empty containers to SE Asia, dropping the empties in Vietnam versus China or not taking them back at all yet,”he said.“That means for at least some carriers in some locations, not the whole market, but ... certain places will start to face empty equipment shortages.

“As carriers cancel or reduce capacity, that means empties are not able to be returned to Asia at the same pace as when they were brought into the US a few months earlier,”Poskus added.

The result will likely be a classic squeeze lasting several weeks, reminiscent of the aftermath of the post-financial crisis restocking surge the market experienced in early 2010.

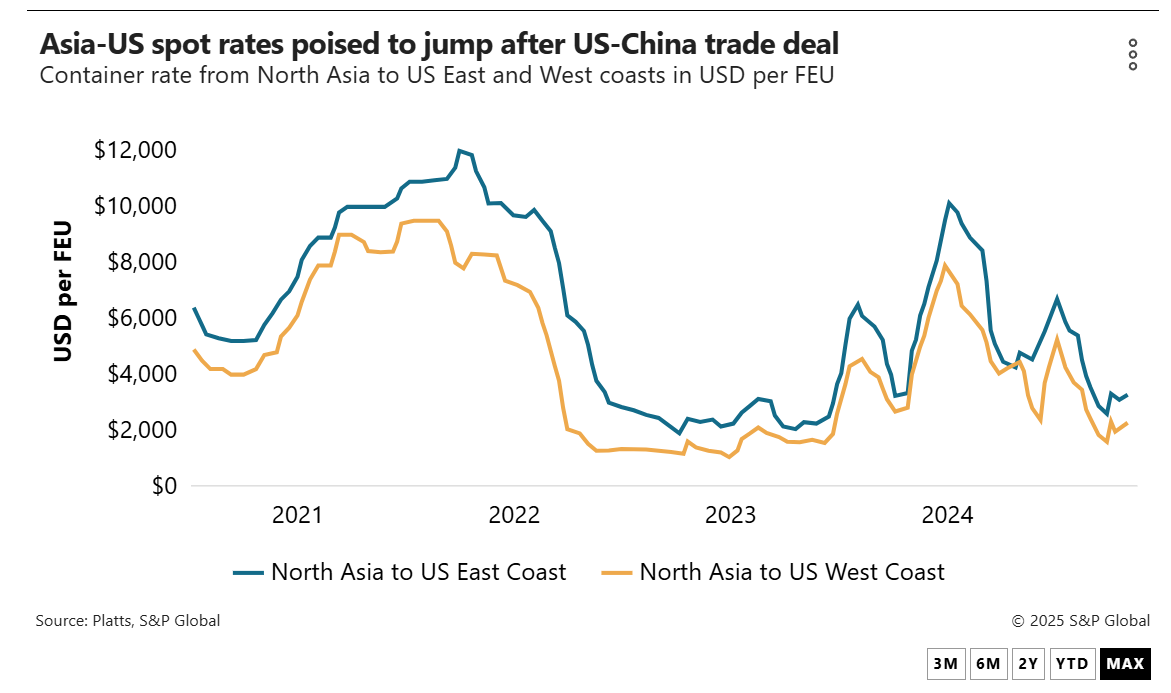

Spot rates, which currently are hovering near $2,400 to the US West Coast, could surge to multiple times that, while peak season surcharges (PSSs) will be likely be quickly imposed on fixed rate contracts.

“If space gets very tight, premium products will be the easiest way to secure additional capacity,”Poskus said.“If your volume is 20 containers a week and you need 25, for the five extra you may need to pay spot market prices plus, possibly, a premium.”