Multipurpose ship operators are keeping a weather eye on a demand slump in the competing container ship sector, plummeting container freight rates and an expected deluge of new container ship capacity, fearing it will prompt mode-malleable cargoes to literally jump ship.

The container sector is bracing for a notable contraction, echoing challenges not seen since the early days of the pandemic. Multiple factors are contributing to this slump — a slowing economy and slowing retail sales among them.

Conversely, the multipurpose/heavy-lift (MPV/HL) sector is eyeing modest growth for 2025, according to exclusive Journal of Commerce analysis, albeit clouded by economic headwinds and regulatory questions. But that growth outlook could diminish if more-than-expected breakbulk cargoes shift to cargo-starved container ships in that forecast period.

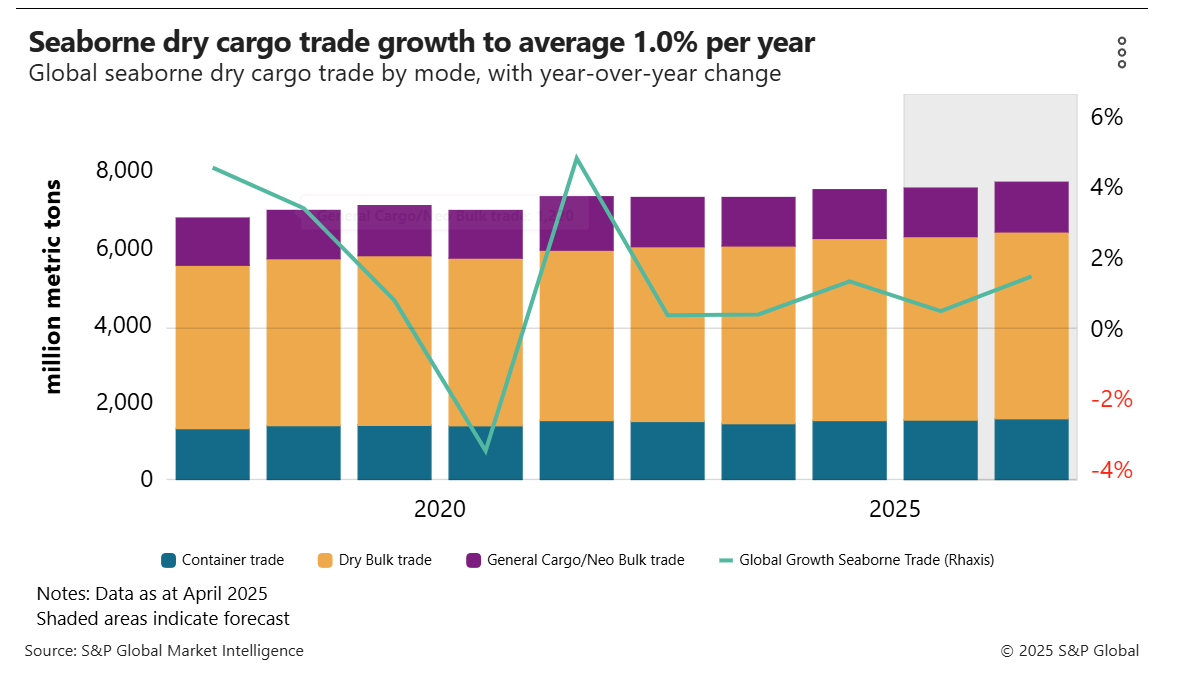

Seaborne dry cargo trade — a catch-all group that includes dry bulk, dry containerized and general cargo — was expected to grow at an average of just 1% per year to 2026, according to an April 2025 forecast from S&P Global Market Intelligence. This forecast was almost halved from the January 2025 forecast report. S&P Global is the parent company of the Journal of Commerce.

Container carriers have some tools to manage the influx of newbuildings: the capacity that arrived in the market over the first quarter of 2025 was mitigated by blank sailings, slower steaming and the withdrawal of capacity in terms of idling, according to container sector experts. But as the situation worsens, this may not be enough, and falling container rates could tempt some cargo traditionally moved as breakbulk to containers.

With the pressures from competing sectors, MPV/HL rates are expected to soften, although shippers attending the Journal of Commerce's Breakbulk and Project Cargo Conference last month said they did not expect them to fall off a cliff the way containers have.

Stark order book differences

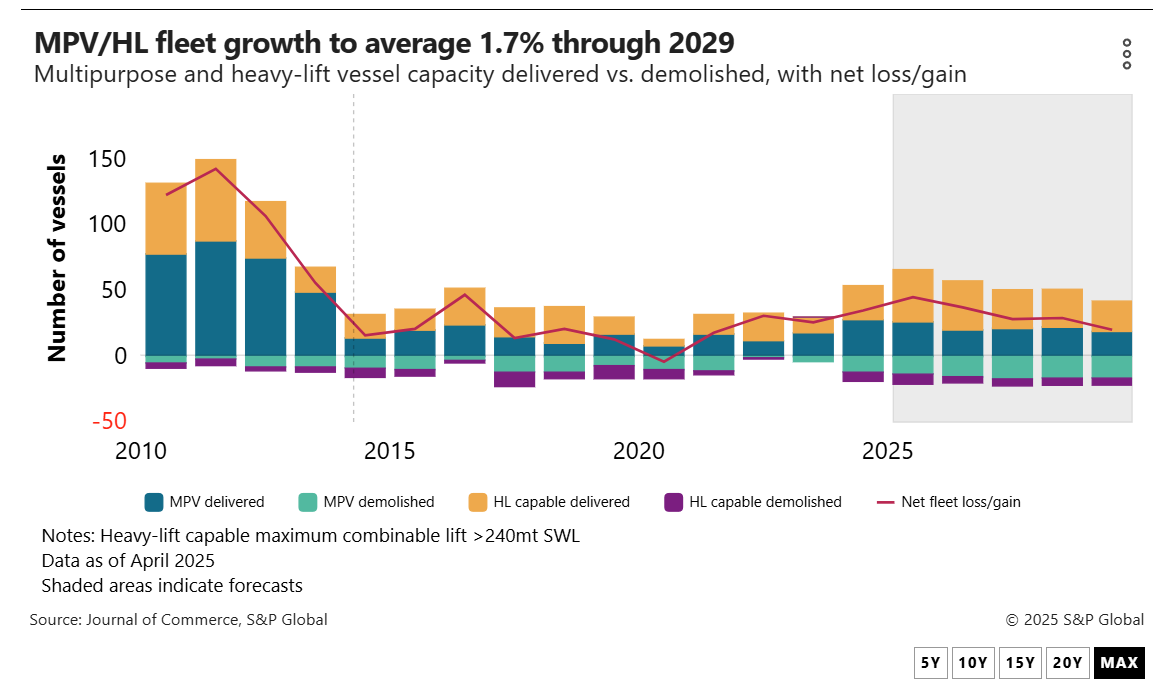

The broader dynamics within the MPV/HL fleet differ starkly from the container sector. The MPV order book is much more modest and is equivalent to just 9% of the operating fleet, according to a Journal of Commerce analysis. Fleet growth projections are equally restrained at an average 1.7% per year to 2029.

However, there are downsides to the limited ship supply pipeline, too. Shippers speaking to the Journal of Commerce have raised concerns about capacity going forward, especially for project cargo that needs heavy-lift vessels or deck carriers.

“Our biggest challenge is capacity — is this going to be sustainable in the future? If you can't get a space at all, that's a bigger problem than a rise in fees,”one shipper said.

In contrast, the project cargo sector, while not immune to global economic trends, presents a different outlook. Project cargo is for the longer term; there is a steady flow of cargo expected over 2025 as projects that have reached a final investment decision are already looking to charter tonnage.

Looming over all sectors has been the United States Trade Representative's (USTR's) Section 301 investigation and potential import tariffs on breakbulk and project cargoes. In the latest iteration of the proposed legislation released April 17, the majority of the MPV/HL fleet would escape the proposed fees targeting Chinese shipbuilding and ownership. However, for affected Chinese-owned vessels, costs could be substantial, according to Journal of Commerce calculations. Based on the initial $50 per net ton, the charges range from an average $280,000 to near $990,000 per ship for the open hatch MPVs that are significantly bigger.

Still, another shipper cautioned that the USTR Section 301 is“not a done deal”and“does not exist in isolation.”

“There is a bigger picture we need to be mindful of,”the source said, pointing to the US Federal Maritime Commission's investigation on global chokepoints as another“one to watch.”