While the Port of Houston still reigns as top gateway, resins shippers are increasingly tapping southeast US ports, thanks to their big-ship capacity and strong connectivity in east-west trades. However, President Donald Trump's tariff actions risk cutting into the steady growth of US resin exports and have virtually shut off US exporters'largest market, China, given the buyer's 125% retaliatory tariffs.

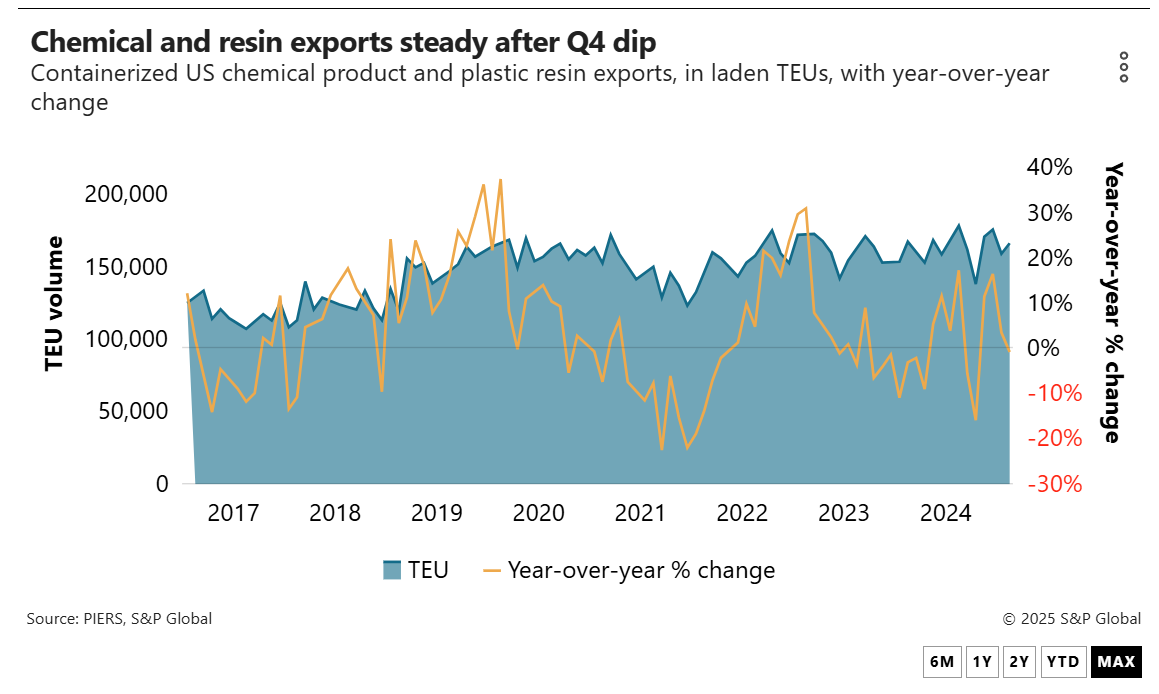

That is coming after a year of modest but steady growth; containerized US chemical and plastic resin exports expanded 1.2% in 2024, the third consecutive annual increase and in line with the sector's five-year compound average growth of 2.1%, according to PIERS, a sister company of the Journal of Commerce within S&P Global. Plastic resins, including polyethylene and polypropylene, represent 57% of US chemical exports.

“It was a fairly decent year of growth,”said Shruthi Vangipuram, a senior research analyst at consultancy Wood Mackenzie.“Not extraordinary, but there were still major participants for US exports.”

With almost all US production concentrated in the Gulf Coast region, resin traders and distributors heavily rely on Houston as their main export gateway. Houston handled about 41.8% of US chemical exports last year and has seen shipments increase at an average annual rate of 6.8% over the last five years, according to PIERS.

The ports of Los Angeles and Long Beach still occupy the No. 2 spot for exports thanks to their proximity to China and high capacity. Even so, chemical exports out of the busiest US port complex have been in decline as shippers seek less congested gateways with easier rail access.

Houston’s long-term export growth rates nearly match those of the ports of Charleston and Savannah, the third- and fourth-busiest export gateways for US chemicals in 2024. The two ports' continued growth follows millions in investments to set up nearby warehouses and facilities for packaging resins into shipping containers.

'Outgrowing'the Gulf

An ocean logistics manager for a global resins distributor and trader told the Journal of Commerce that an increasing share of his company's exports are moving through Southeast ports thanks to the diversity of container services and routes for exports. While Houston still has a solid lead in north-south shipments, bigger vessels calling the Southeast allow more capacity on east-west trades.

“We have been sending more rail cars to Savannah,”the source said. The company is moving cargoes destined for Asia, Europe, the Mediterranean and Africa through Savannah and those headed to Latin America through Houston, he added.

Houston is working to add vessel capacity through its “Project 11,”which entails widening and dredging the Houston Ship Channel. Ships will have bi-directional navigation on the channel, allowing for faster berth calls. But with the channel's depth at about 46 feet, larger post-Panamax vessels will still be somewhat limited in their ability to call Houston.

“The resin business has already outgrown Houston,”the logistics manager said.“There's just not enough capacity.”

North-south trades, however, likely still managed to push Houston's export volumes higher in 2024. Chemical volumes from the US to Brazil, for example, grew 22% last year. Vangipuram said Argentina and Colombia are also growing consumers of US resins.

“Latin America is the [resins] export destination of choice for the US,”Vangipuram said.

But the north-south resin trade out of the US Gulf poses its own challenges, the ocean logistics manager said, particularly with alliance carriers and those that have slot exchange deals for capacity.

Because of port congestion in Brazil, many ships in north-south trades have been off schedule. Ocean carriers try to make up for the time by skipping calls at transshipment ports in the Caribbean and South America, but that can leave cargo booked through slot swaps or alliances stranded.

“If the ships are coming a week late out of Brazil and the carrier has to make up time, what they are going to do is omit the other carrier's transshipment port,”the logistics manager said. He said the cargo rolls and delays were most common at the ports of Kingston, Jamaica, and Cartagena, Colombia.

With direct services to the other two largest US resins markets, Asia and Europe, shipments out of Southeast ports are not seeing similar issues. But overseas retaliation to the Trump administration's tariffs is likely to have a major impact on the resins trade this year.

After Trump put a 90-day pause on 20% reciprocal tariffs on goods from the European Union, the trading bloc similarly backed down from its own retaliatory measures. While the EU may exempt US resins from any retaliatory duties due to the region's dependence on imports, the logistics manager said a prolonged trade war could favor resin producers in the Middle East.

“Our team in Europe said that resins won't be on the list for retaliation against US,”the manager said.“But no one has showed me anything yet that resins have been exempted. Until then, we're being very cautious.”