The rush of imports into the US ahead of the implementation of tariffs has boosted less-than-truckload (LTL) freight volumes — but unevenly, sources tell the Journal of Commerce.

LTL carriers close to major seaports and US border crossings are picking up“pull-forward”freight, with national carriers likely seeing less of an uptick than some regional carriers.

One of the hot markets is along the US-Mexico border, which has seen waves of freight spurred by the US-Mexico trade dispute.

“We have seen a noticeable but manageable increase in our cross-border traffic at our Texas border facilities,”said Kent Williams, executive vice president of sales and marketing at Averitt, a Tennessee-based regional trucking company.

The increase has primarily been in LTL volume, Williams said, though Averitt's other business lines — which include truckload and drayage — have enjoyed higher demand since the beginning of March as well.

“We have been busy over the course of the past 30 to 45 days with respect to our dray and transload business at all our portside facilities across the south, likely due to the push to get ahead of the tariffs,”Williams told the Journal of Commerce.

But the other shoe, in terms of international imports, is about to fall.

“Our international [non-vessel-operating common carrier] group is reporting a noticeable decrease in our import container bookings from China, which is no doubt due to the tariffs,”said Williams.

Booking cancellations could leave some ships departing China half-empty through May. That suggests any tariff-related bump in US LTL freight is likely to be short-lived.

“We're still dealing with a very soft market with no imminent sign of when it gets better,”said Mike Regan, chief relationship officer at TranzAct Technologies, a supply-chain consulting firm.

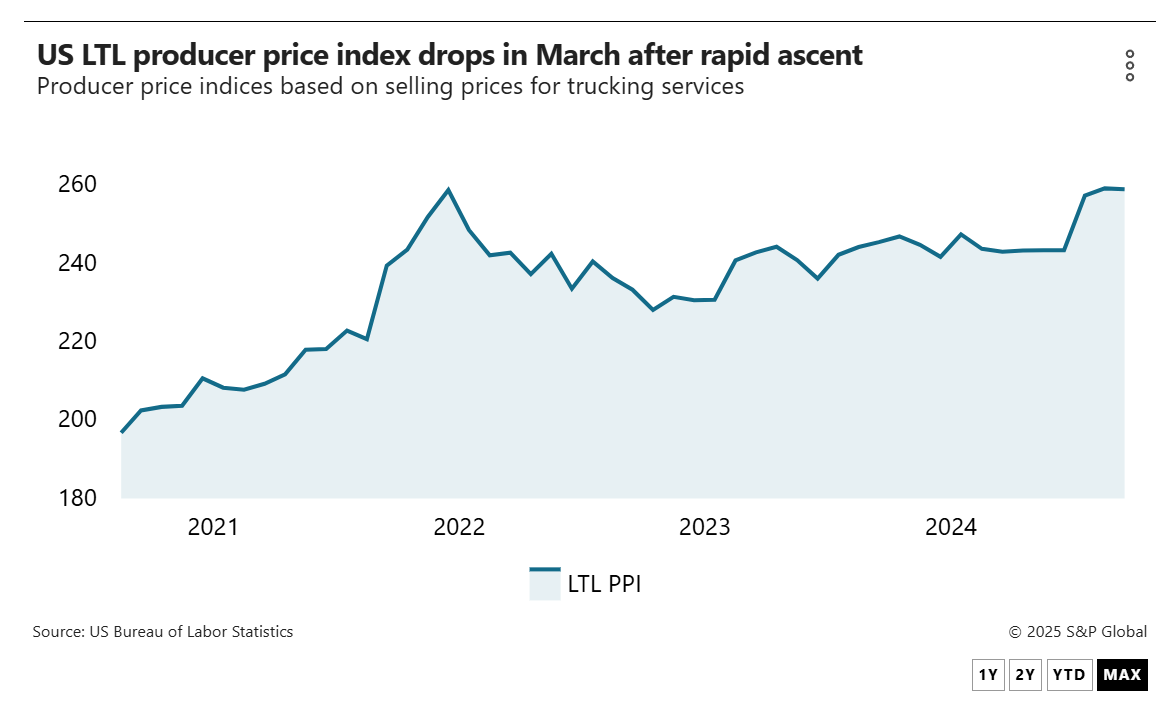

The long-distance US LTL producer price index (PPI), a measure of all-inclusive LTL costs to shippers, dropped slightly in March after shooting up in January and February.

The PPI's fluctuations may reflect some pulled-forward freight, but also temporary gains in manufacturing output and higher replacement rates in some LTL contracts.

Tariffs and timing

Some LTL executives and analysts, although not all, are reporting a slight bump in LTL demand that correlates with a“pull forward”of freight from Asia, Europe, Mexico and Canada, all targets of US tariffs.

Estes Express, a national LTL carrier, may have had some pull-forward business in January and February, President Webb Estes told the Journal of Commerce.

“It's hard to ever say [an increase in volume] is definitely because of this or because of that,”Estes said. Bad weather and higher manufacturing output may have also affected shipment counts at Estes, the largest privately-owned US LTL company.

“I would say in the last four weeks or so [the market has been] maybe 2% to 2.5% softer than I anticipated, but a whole lot of things can factor into that,”he said.

For one, US manufacturing in March slipped to its lowest rate of expansion so far this year, dropping to 50.2 from 52.7 in February, according to the S&P Global Purchasing Managers'Index (PMI).

Even so,“there's not been any monumental fall-off in volume,”said Estes.“It just hasn't popped like we're used to [in March and April].”

“Our current LTL shipment numbers don't show any increase, or decrease for that matter, based on pending tariffs,”said Chris Jamroz, CEO and executive chairman of long-distance LTL provider Roadrunner.“We have noticed some shippers pre-positioning freight and building inventory to stock in domestic warehouses, but these moves are mostly impacting airfreight, intermodal and truckload.”

Shippers and analysts refer to a“steady state”market restrained by uncertainty over the Trump administration’s tariff plans and their impact on the global economy.

More detail on LTL volume changes will become available as the large publicly-traded carriers release their first-quarter earnings over the next few weeks.

“If we're seeing anything, it's steady [LTL] volumes,”said Aaron LaGanke, vice president of freight services at AFS Logistics, a third-party logistics provider, freight payment firm and producer of the quarterly TD Cowen / AFS Logistics Freight Index Forecast.

LaGanke sees economic uncertainty holding back the market.

“There are shippers who are pausing and asking,‘What should we do?’”he said.“People want to make decisions based on data. When the information they get changes every day, it's really hard to do that.”

AFS Logistics expects its LTL freight index to decline 0.4 percentage point from the first quarter to 63.4 in the second quarter — still up 0.7% from a year ago.

“If there are spikes in demand, they're in specific geographic areas, not overall,”he said.

Wall Street investment firm Stifel still expects flat to moderate growth in LTL volumes in the second quarter, with“choppy demand fundamentals.”

“It's difficult to ascertain whether demand has been pushed further out or has dried up,”Stifel said in a note to clients.