Just weeks after signing 2025–26 service contracts with trans-Pacific ocean carriers at $1,600 to $1,800 per FEU for West Coast imports, big-box retailers are attempting to knock those numbers down as they look to assign their remaining cargo to liners they have yet to ink deals with.

That final push, which will play out in the coming weeks, may face some headwinds, however. That's because a general rate increase (GRI) implemented by carriers on April 1 has largely stuck, giving shippers less leverage in attempting to lower contract rates for next service year.

The largest big-box retailers in recent weeks signed annual service contracts with their core carriers in the range of $1,600 to $1,800 per FEU from Asia to the West Coast and about $2,600 to $2,800 per FEU to the East Coast. Those rates are about 15% to 20% higher than what they signed for in their existing 2024–25 contracts.

Most contracts will run from May 1 through April 30, 2026.

The Journal of Commerce spoke with 10 forwarders, three carriers and two consultants for this story.

Large retailers ship with multiple carriers, and they are reportedly negotiating with their remaining core carriers for lower rates. However, most carriers on Tuesday implemented GRIs of up to $1,000 per FEU on spot rates.

“It's pretty much across the board for almost all carriers,”Kurt McElroy, executive vice president at the forwarder Kerry Apex, said of the GRIs.

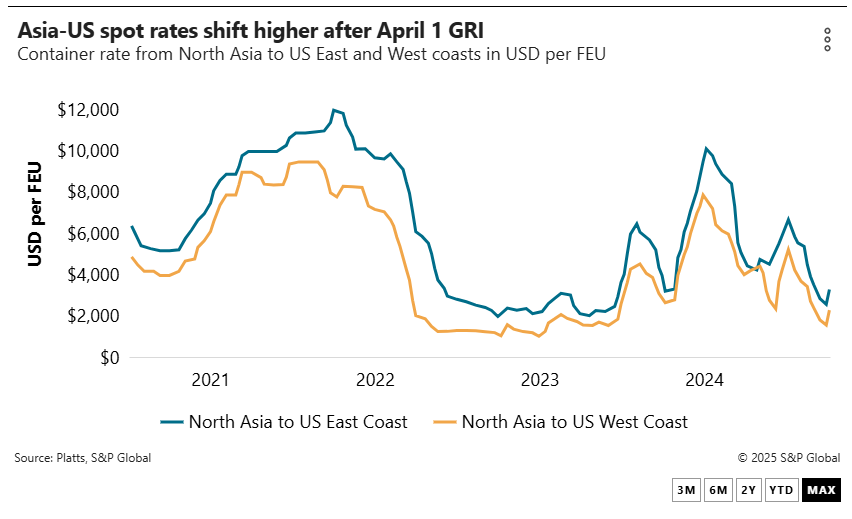

Platts, a sister company of the Journal of Commerce within S&P Global, pegged spot rates to the West Coast at $2,275 per FEU as of Thursday, up 42% week over week. The East Coast rate was exactly $1,000 higher at $3,275/FEU, up 26%.

Carriers attempt to leverage rising spot rates into higher contract rates as they finalize contract negotiations with customers.

GRIs providing support for carriers

When contract negotiations in the eastbound trans-Pacific began earlier this year, carriers said they were aiming for rates of $2,000 per FEU to the West Coast and $3,000 to the East Coast with their largest customers. By setting the floor at those rates, carriers would then attempt to sign the second tier of customers for a couple of hundred dollars per FEU higher.

But with spot rates in decline until late March, carriers were forced to accept levels about $200 to $400 under their expectations. Now, with a mostly successfully GRI to provide support, they are making a final push to reverse the momentum and get close to their original goal, Ben Coleman, president of the forwarder Teampower Logistics, said.

“They started with $2,000 [to the West Coast], then early signings dropped that to $1,600-$1,800, and now they're trying to claw back to $2,000,”Coleman said.

An industry consultant who formerly served as a logistics manager with national retailers said it is not unusual for larger importers to attempt to secure lower contract rates from each carrier they deal with until all their volume has been committed.

“They will try to get the best rates they can,”the source said.“Maybe they can get it done with some contracts, but not all.”

A carrier executive echoed that point, but noted retailers could end up being shut out by some lines.

“The more you try to push down rates, the riskier it will be to get space,”the executive said.“Still, some are still trying to leverage their volumes.”

A forwarder said even though the April 1 GRI may not be as fully effective as carriers would like, they appear resolved to reach their initial goals for service contract rates.

“We are moving forward with our contract discussions, and benchmarks, at least for named accounts, remaining at $2,000 [for the West Coast] and $3,000 [for the East Coast], respectively,”the source said.

Some carriers this week launched a second round of negotiations with non-vessel-operating common carriers (NVOs), which will put additional pressure on importers to wrap up their contract negotiations, a second forwarder said. He estimates that most NVO contracts will settle near $2,000 per FEU to the West Coast.

Some importers had resisted finalizing their contracts until the Trump administration announced its tariff policy, but with Wednesday's announcement, those retailers and other importers with fall merchandise to book are likely to finalize their contracts and step up their bookings, forwarders said.

With spot rates higher, bookings in Asia picking up and importers looking beyond the tariffs to finalize their fall and holiday merchandise needs, shippers realize they can't wait much longer to wrap up their contract negotiations, one forwarder said.

“There's been a different dynamic the last 72 hours,”the source said.