French waste management company Suez has signed a deal with CMA CGM to produce 100,000 metric tons of biomethane per year between now and 2030 to power the carrier’s fast-growing renewable fuel fleet.

In a memorandum of understanding, the two companies also committed €100 million ($108 million) via a joint investment program to develop biomethane production facilities. Biomethane is a renewable fuel produced through waste recovery and is essentially a cleaner version of LNG.

Rodolphe Saadé, CEO of the CMA CGM Group, called the strategic partnership with Suez “a major step forward” in the carrier’s energy transition toward carbon neutrality by 2050.

“It will enable us to support the biomethane sector dedicated to the shipping industry, while accelerating the

1CMA CGM Group and guaranteeing our carbon neutrality trajectory by 2050,” Saadé said in a statement Tuesday.

The aim of the partnership between the two companies is to establish a long-term industrial collaboration on biomethane. Besides Suez supplying 100,000 metric tons of biomethane per year to be used by CMA CGM in its gas-powered ships and the creation of a joint investment structure for the development of biomethane production sites in Europe, a third area of collaboration will be in research and development initiatives aimed at designing innovative technologies to produce biofuels via a hydrothermal gasification process.

CMA CGM has invested $18 billion in orders for 131 vessels capable of sailing on both fossil fuels and low- or zero-carbon alternatives such as biomethane, biomethanol and synthetic fuels. Most of the vessels will be operational by 2028. The carrier is also making deals with fuel producers to develop production facilities and fuel supply chains and lock in supply for the new ships as they come online.

Unviable fuel pathways

The availability of alternatives to fossil fuels ahead of interim 2030 emissions reduction targets set by the International Maritime Organization (IMO) is having a greater impact on the ship-ordering process, with carriers wary of locking themselves into an unviable fuel pathway.

The need to keep fuel options open was illustrated in a recent Maersk order for dual-fuel vessels totaling 800,000 TEUs capable of sailing on methanol as well as LNG, a deviation from its deep dive into methanol.

Morten Bo Christiansen, Maersk’s head of decarbonization, said although methanol would continue to lead the carrier’s efforts to meet its science-based emissions targets, having a portfolio of fuels was important.

“We now believe that biomethane is going to play a meaningful role in the green future fuels mix and we need to tap into that market,” Christiansen told the Journal of Commerce in a recent interview.

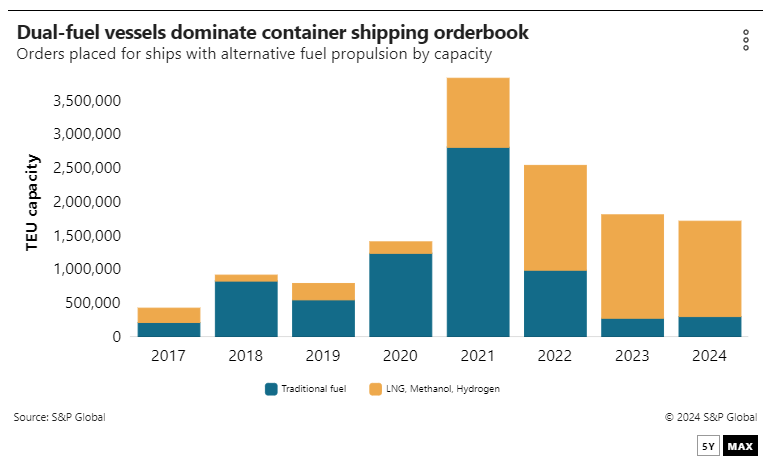

Despite a surge in methanol-capable ship orders last year, LNG-powered vessels remain the largest alternative fuel segment in the industry order book. Data from Sea-web, a sister company of the Journal of Commerce within S&P Global, shows methanol ships comprise 21.1% of the order book, LNG 33.3% and traditional bunker fuels 45.6%.

Fears of insufficient methanol supply have multiplied this year as the fuel’s processing costs have proved higher than expected and planned production has failed to take off, Alphaliner wrote in its weekly newsletter.

Referencing a recent study by the Methanol Institute, the analyst noted that more than two-thirds of planned methanol production facilities have yet to receive final budget approval. Instead, carriers have pivoted back to LNG propulsion, ordering a record 1.76 million TEUs of capacity this year, equivalent to 55% of the year’s total capacity ordered and four times the 440,000 TEUs ordered in 2023.