Aug 5, 2024

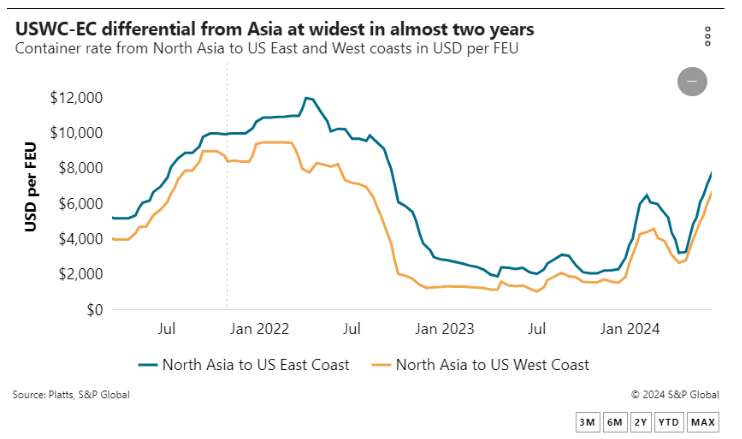

The differential between spot rates from Asia to the US West and East coasts is at its widest in almost two years amid signs of a significant loosening of capacity to the West Coast and importer worries over the coming expiration of the labor contract covering 45,000 dockworkers on the East and Gulf coasts.

In a further sign of the easing of available capacity to the West Coast, carriers have begun to offer “blended rates” that split bookings by customers between fixed rates and much higher spot rates. Container spot rates to the West Coast began easing in early July thanks to the launch and reintroduction of at least 10 services.

The differential between East and West coast rates was reflected in a surge of bookings with non-vessel-operating common carriers (NVOs), whose share of the Asia-US market climbed to 51.2% in July from 44.3% in April, according to PIERS, a sister company of the Journal of Commerce within S&P Global.

NVOs generally have business relationships with alliance liners in the trans-Pacific, as well as smaller non-alliance carriers on the trade. That gives their clients more options for securing vessel space in a volatile market.

The spot rate from Asia to the East Coast as of Aug. 2 was $9,500 per FEU, while the West Coast spot rate was $6,400 per FEU, according to Platts, a sister company of the Journal of Commerce within S&P Global. The $3,100 differential between the rates is the widest since October 2022.

East Coast rates expected to soften

NVOs and carriers expect East Coast spot rates to decline in the second half of August because merchandise imports on all-water services to the East and Gulf coasts must depart Asian load ports by mid-August to reach store shelves in time for the Black Friday sales on the day after Thanksgiving.

Also, because the voyage time from Asia to the East and Gulf coasts is about 30 days, retailers and other importers who wish to ensure they are not caught up in a potential strike by the International Longshoremen’s Association are rushing to book their shipments by mid-August. The ILA’s existing contract expires on Sept. 30.

“Aug. 15 is pretty much the last hurrah for the East Coast,” a carrier executive told the Journal of Commerce.

“It will get too risky [to ship to the East and Gulf coasts] after Aug. 15,” said Bob Fredman, principal at the logistics consultancy SF Global Insights who formerly managed logistics operations at a large retailer.

The Journal of Commerce spoke with two importers, two carriers and three NVOs for this story.

Blended rates good for carriers, customers

As imports from Asia grew rapidly this spring, NVOs and even some retailers said carriers were not filling the allotments they had in their contracts. However, with vessel space to the West Coast having eased over the past month, carriers are honoring the allotments. But there’s a catch.

Some carriers are offering blended rates in which the customer can book containers at the fixed rate in their service contracts, which is generally about $1,500 to $1,600 per FEU for midsize shippers and NVOs, provided they match each fixed-rate container with another booked at the much higher spot or freight-all-kinds (FAK) rate, the carrier executive said.

If a customer pays about $1,500 per FEU for each fixed-rate container and about $6,500 for each matching spot or FAK container, it averages out to about $4,000 per FEU, the carrier source said. That works to the advantage of the carrier as well as the customer because it prevents the spot rate from falling too rapidly.

“Carriers are trying to keep the FAK rates as high as possible,” the carrier executive said.

Spot and FAK rates to the East Coast have fallen about $650 from their peak in mid-July, according to Platts. However, those rates should not plummet because many large retailers have distribution centers on the West, East and Gulf coasts and must continue to ship at least some of their merchandise through all three regions, said an industry consultant who served as a logistics manager at two national retailers.

Even in the event of an ILA strike, “Most large BCOs [beneficial cargo owners] can’t ship it all through the West Coast,” the source said.

Aug. 15 GRI, PSS likely to fall flat

Trans-Pacific carriers in May began filing general rate increases (GRIs) twice monthly with the Federal Maritime Commission. They also filed a GRI effective Aug. 1, but that didn’t stick due to the softening market. Carriers had some success recently implementing peak season surcharges (PSSs), but the swing in pricing power means customers are able to reject those, too.

“No PSS and no GRI. [Carriers] are trying for an [Aug.15] increase, but I do not think it will stick,” said an importer in the automotive sector.

An importer of home furnishings said two of the five carriers he contracts with attempted to charge a PSS, but he turned them both down. “We think they will back off,” the source said.

Whether or not BCOs experience a traditional peak season increase in import volumes remains to be seen, shippers, carriers and NVOs said. Global Port Tracker, which is published monthly by the National Retail Federation and Hackett Associates, has forecast that US imports will increase 13.5% in August and 3.5% in September year over year.

Carriers are booked through mid-August to the East Coast, which should keep those rates high for the next couple of weeks. But import volumes for the rest of the peak season are still unclear, said Kurt McElroy, executive vice president of the NVO Kerry Apex.

McElroy does not anticipate a large spike in imports or spot rates to either the West, East or Gulf coasts in the event there is no ILA strike, nor does he anticipate a drastic drop in rates in the traditionally slow months of November and December.

“I think it will be pretty orderly,” he said. “I think carriers are finding an orderly balance.”