Have some sympathy for the shipper dependent on ports along the US East and Gulf coasts. They have few options -- none of them great --if longshore labor, as threatened, strikes at the end of September if an agreement isn’t reached by then.

It’s nearly too late to join other importers that have frontloaded cargo to those ports, with mid-August being the latest Asia shipments can be loaded at origin and arrive before Sept 30. Even if an expedited US West Coast routing is possible, Asia outbound capacity has been tight since late July, though there are signs of loosening in August.

Canadian routings for inbound cargo come with their own challenges, including labor threats north of the border. Diversions through Mexico have been aggressively sought,but rarely achieved by the connecting railroads.

That leads to a sense of helplessness among US importers and exporters alike as the clock ticks on the International Longshoremen’s Association existing contact. Container lines aren’t offering “Plan B” options, according to discussion with carriers and cargo owners.Rerouting services to avoid the US East and Gulf coasts come with their own challenges, which are still exacerbated by an earlier peak season weighing on already stretched capacity and container equipment due to ongoing Red Sea diversions.

Asia–US container spot rates have been easing since mid-July but are still well above $6,000 per FEU to the West Coast. Anecdotal reports of carriers and forwarders offering up now-available slots for August also suggest loosening capacity ahead, but hardly a significant slackening.

The National Retail Federation (NRF), in its most recent Global Port Tracker (GPT), said it expects US imports in August will jump 13.5% over the same month a year ago. That’s up from June’s GPT, which forecast that August’s imports would climb 10.6% year over year, a reflection of resilient consumer demand despite an early peak season and increasing signs of less afluent Americans cutting back on spending.

No great options

The Biden administration, meanwhile, hasn’t offered any public assurances that it’s monitoring talks between the ILA and the US Maritime Alliance. But acting Labor Secretary Julie Su, who was instrumental in breaking the US West Coast labor stalemate last year, is aware of the status of the talks, according to sources familiar with the matter.

ILA President Harold Daggett’s warning for the Biden administration to stay out of the way doesn’t bode well for armonious down-to-the-wire discussions. As of late July, the master contract talks remained stalled due to a dispute the ILA has with APM over automation projects at its Port of Mobile container terminal.

Shippers have few commercial options amid such uncertainty that they have little power to influence. Some shippers whose networks allow West Coast routings have leased additional short-term warehouse space in Southern California. The daring -- or foolhardy, perhaps -- could try to bring imports through a small port or marine terminal that doesn’t utilize ILA labor.

Routing though Eastern Canadian ports may work for some import distribution networks in the US Northeast or even the Midwest. Canada diversions, though, carry their own risk, including the specter of a country-wide rail strike, a foremen strike at the Port of Vancouver and an expired Montreal labor contract.

Canadian Pacific Railway CEO Keith Creel on Tuesday was downbeat on prospects for a breakthrough in the contract stalemate with unions representing conductors and engineers, saying both sides are far apart and there’s little room for employers to budge.

US shippers have shifted routings away from Canada to the US due to fears of a country-wide strike by the Teamsters Canada Rail Conference, Canadian National Railway told investors on July 23.

Routing through Mexican ports and then railing imports across the border holds even less potential for US East and Gulf coast importers, given the longer overland transits and the fact that Asia outbound capacity to Mexico is also tight despite carriers adding more services.

The trustiest lever for importers to pull is simply to take on more inventory, with logistics managers telling the Journal of Commerce they have at least two weeks’worth of inventory. That may be more than enough.

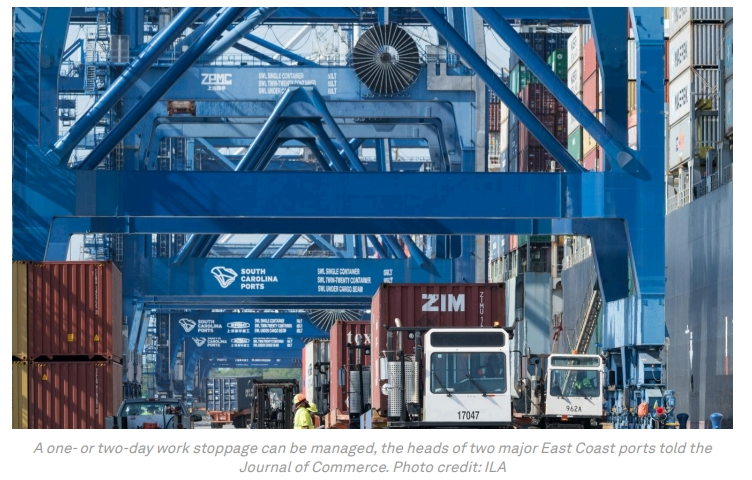

A one- or two-day work stoppage can be managed, the heads of two major East Coast ports told the Journal of Commerce, pointing to how they prepare for long holiday weekends and clear any backlogs quickly. But a work stoppage that drags on for five or six days can take some ports up to a month to return to normal performance.