Consumer demand for imported apparel and footwear is rising so far this year after import volumes fell for the first time in three years in 2023, but retailers are still reluctant to bring in a lot of new inventory out of fear of being overstocked again.

“Consumer demand was down as our members were still trying to clear out their excess inventory,” said Nate Herman, senior vice president of policy for the American Apparel and Footwear Association. “This year, we’ve started to see that slowly turn on both sides, both [a] small uptick in consumer demand as well as our members have finally cleared out the inventories. But it’s very slow at this point.”

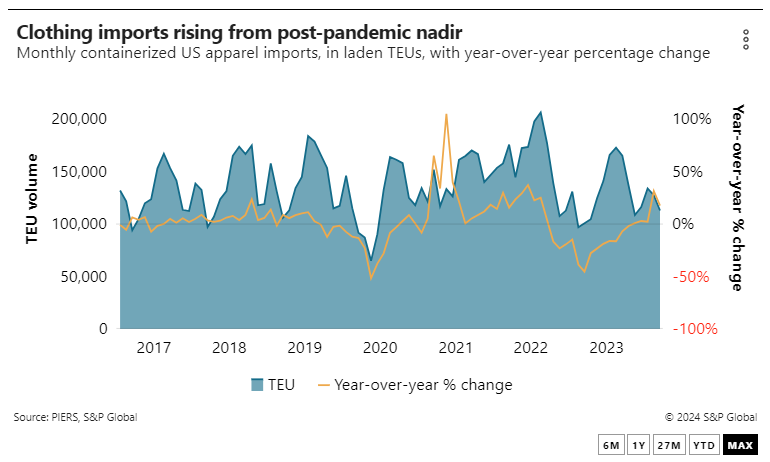

US apparel and footwear imports plummeted 18.7% to 1.6 million TEUs last year, the lowest level since 2020, but have since rebounded, climbing 15.6% year over year in the first quarter, according to PIERS, a sister product of the Journal of Commerce within S&P Global.

Clothing shippers have also been shifting where their cargo lands in the US from the West Coast to the Gulf and East coasts. West Coast ports handled 53.8% of total apparel and footwear imports last year, down from 62.3% in 2018.

“The transition during COVID took us to the point where now nearly half of our product is coming through to the East or Gulf,” Herman said. “But that also means our members have new concerns. We have already sent a letter to President Biden about the East Coast labor contract negotiations because we’re very concerned about that. We’ve had an impact because of the Red Sea crisis, which is nowhere near any sort of conclusion at this point.”

Although most shippers have adjusted their supply chains to account for the longer transit times around southern Africa due to diversions away from the Suez Canal, some designer fashions produced in Bangladesh, Indonesia and Vietnam are more time-sensitive.

Eyes on Washington

Clothing importers are also watching multiple pieces of federal legislation on Capitol Hill covering de minimis rules — which exempt shipments valued at less than $800 from import duties and tariffs — and foreign trade zones (FTZs).

The US Foreign Trade Zone Parity Act, for example, would extend de minimis rules to cargo destined for FTZs within the US. While e-commerce shipments valued at $800 or less are exempt from duties, shipments from US-based FTZs currently do not enjoy the same benefit.

A footwear importer who asked not to be identified said allowing FTZs to take advantage of de minimis rules would improve their business.

“The [FTZ] bill matters to us because we operate FTZs inside the US, but we don’t source from China anymore,” the shipper said. “If you are manufacturing in other countries and you’re trying to do fulfillment in the US, given the way de minimis works, you’re penalized in a way for doing fulfillment in the US versus if you wanted to be just over the border in Canada or Mexico.”

Another piece of legislation, the De Minimis Reciprocity Act, would alter how the US Department of Treasury calculates de minimis values based on the trade relationship with a particular country. Some clothing shippers are concerned the bill would result in the elimination of de minimis rules for imports from China.

Both pieces of legislation could have a material impact on the economic factors that go into decisions around the sourcing and annual volumes of merchandise imports.

Apparel and footwear shippers sourced 42.1% of their imports from mainland China last year, down from 47% in 2018 but still a larger share than the next four largest suppliers — Vietnam (19.6%), Bangladesh (5.8%), Indonesia (5.3%) and Cambodia (3.8%) — combined, according to PIERS.