It is a buyer's market during this annual trans-Pacific service contract cycle, and importers of Asia-sourced goods — particularly smaller shippers — are under some of the strongest C-Suite pressure in years to reduce costs. But shippers should also heed signs that ocean carriers have managed to keep the decline in Asia imports from sinking the market, reflecting a modicum of control and price restraint.

A few container line executives privately acknowledge what preliminary contract benchmark readings reflect: The starting point for contract rate levels is lower than during last year's negotiation cycle. Demand is weaker than a year ago, and capacity is more plentiful as evidenced by the swelling order book.

In the first two rounds of bids in this annual service contract cycle, tendered rates for Asia to the US West Coast were down approximately 25% from levels in January 2025, according to a Xeneta analysis. However, the tendered rates in this cycle have been rising since the beginning of the year, said Emily Stausbøll, senior analyst at Xeneta.

“We certainly expect that as more US shippers start tendering, they should be saving money compared to last year, but how much depends on shippers' individual negotiations and whatever happens in the market over the next few months before many of those contracts are finalized,” Stausbøll said.

C-Suite calling

The pressure on logistics managers to cut costs has risen dramatically in less than a year, making it infeasible to simply pass on the additional costs to suppliers and/or suffer weaker margins. The US tariff rate on imports from China more than doubled to 47.5% between January and November 2025, according to the latest available analysis from the Peterson Institute for International Economics.

No wonder then that a recent Goldman Sachs survey found that between April and August of last year, surveyed businesses passed 37% of higher tariff costs to consumers and 9% onto suppliers. The companies absorbed the remaining 51%, according to the study released in October.

Small and medium-sized importers are ordering only what they know they can sell and taking an even harder look at their own transport costs, said Serkan Kavas, executive vice president for imports at the forwarder MTS Logistics.

For example, shippers who booked before a general rate increase (GRI) was imposed but didn't ship until after it was implemented have become more sensitive to the higher transport cost they've accrued, and often with one day or less of notice, he said. A cost difference of $50 per TEU matters more now.

“It's all about cost,” Kavas said. “The service reliability has not been too bad. There is an abundance of space. On the carrier side, there is not too much difference to the level of service.”

In a down market, in which analysts expect US imports to barely register any growth in 2026 compared with 2025, some ocean carriers are targeting smaller shippers that they would have normally left to forwarders. One of Kavas’ customers, he said, was approached by a major carrier for annual volumes of no more than 1,000 TEUs.

Holding the line so far

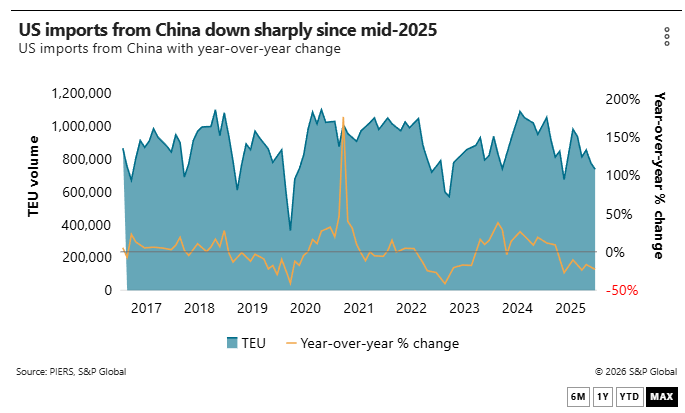

While volumes are plunging, pricing isn’t. US imports from China in December dropped 22.3% year over year while total volumes from Asia fell 6.1% in the same period, according to PIERS, a sister company of the Journal of Commerce within S&P Global.

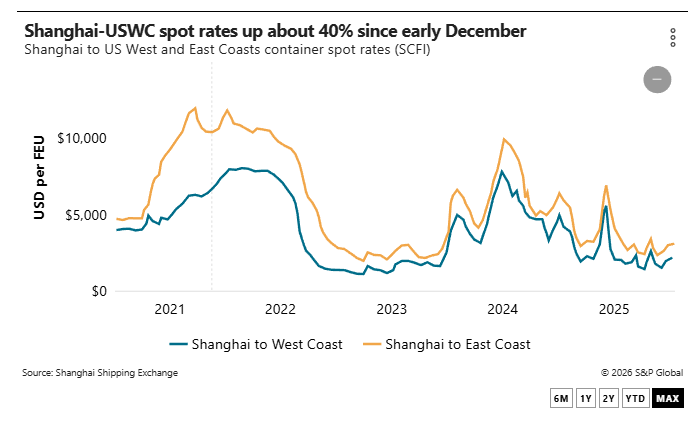

Yet container spot rates, as measured by Drewry, Platts and the Shanghai Shipping Exchange, have shown resilience, rising about 40% since early December. Implementing blank sailings and moderately-sized GRIs while holding the price line on freight-all-kind rates appears to have worked for carriers.

“Ocean carriers need another catalyst to keep the rates at certain levels, or they will continue to perform blank sailings which they have mastered,” Kavas said. “They are doing this in a very disciplined manner, and considering the number of carriers in the market at the moment, ocean freight rate fluctuations will continue to be present, but I don’t see rates are diving.”

Ocean carriers are adjusting further to expectations of reduced demand. Carriers will reduce the available capacity from Asia to North America to 2.5 million TEUs in the first quarter from 2.6 million TEUs in the fourth quarter, according to Xeneta forecasts and an analysis of blanked sailings, including those not announced by carriers.

The semblance of carrier control on the trans-Pacific despite weakening volumes should give importers pause amid negotiations on annual contracts, which generally run from May 1 through April. The market may be down, but capacity discipline so far isn't, and shippers who push too hard on contract rates or are too exposed to spot rates could end up paying if the market turns.