The largest US retailers are signing their 2025–26 service contracts in the eastbound trans-Pacific at rates that are about 15% to 20% higher than they signed for last year, with midsize importers likely to finalize deals in the coming few weeks at slightly higher rates.

Three carriers, seven non-vessel-operating common carriers (NVOs) and two industry consultants told the Journal of Commerce those major retailers have signed service contracts over the past week. The rates in those contracts, which essentially set the floor for negotiations with midsize and smaller shippers, range from $1,600 to $1,800 per FEU from Asia to the US West Coast, and about $1,000 per FEU higher than that to the East Coast. Most trans-Pacific service contracts will run from May 1 through April 30, 2026.

Last year, the largest big box retailers signed service contracts in the range of $1,400 to $1,450 per FEU to the West Coast and about $1,000 per FEU higher to the East Coast. However, within weeks of those agreements being signed, spot rates popped to levels not seen since the COVID-19 pandemic due to surging demand and frontloading of imports prior to the expiration of the dockworker contract on the East and Gulf coasts.

Several midsize importers — those shipping 30,000 to 40,000 containers per year — are in their second round of negotiations and are expected to sign for rates that are about $100 to $150 per FEU higher than what the largest retailers will pay.

“Most of those contracts are done or nearly done,”a carrier executive who asked not to be identified told the Journal of Commerce Wednesday. He expects midsize retailers and other importers to secure contract rates in the range of $1,700 to $1,900 per FEU, up from $1,500 to $1,700 per FEU last year.

NVOs said their negotiations are likewise on schedule, with the first round nearing completion. They expect to wrap up their contracts later in April.

“They're coming down from the $2,500 initial offer,”said Chistian Sur, executive vice president of ocean freight at Unique Logistics International.“We haven't gotten below $2,000 yet.”

A wider range of rates

Shippers and carriers say that due to uncertainties in the global trade environment, including the Trump administration's tariffs, the possibility of a tax on US port calls by Chinese-operated and -built ships, continued disruptions in the Red Sea and questions over consumer demand in the second half of the year, the range of service contract rates is greater this year than in past years.

“The market is really unsettled,”said Benton Kauffman, head of trans-Pacific air and sea logistics at the forwarder DSV Transport Logistics.

“Rates are all over the place,”said James Caradonna, executive vice president at forwarder Spedag Americas. Some large importers who held out too long in the 2024–25 contract negotiations and then could not secure sufficient space when US imports from Asia surged by double-digit percentages agreed to rates on the higher end of the spectrum this time around, he noted.

The carrier executive said he believes most large customers are trying to spread out their minimum quantity commitments (MQCs) among multiple carriers, which is likely one of the main reasons behind the wider range of pricing this year.

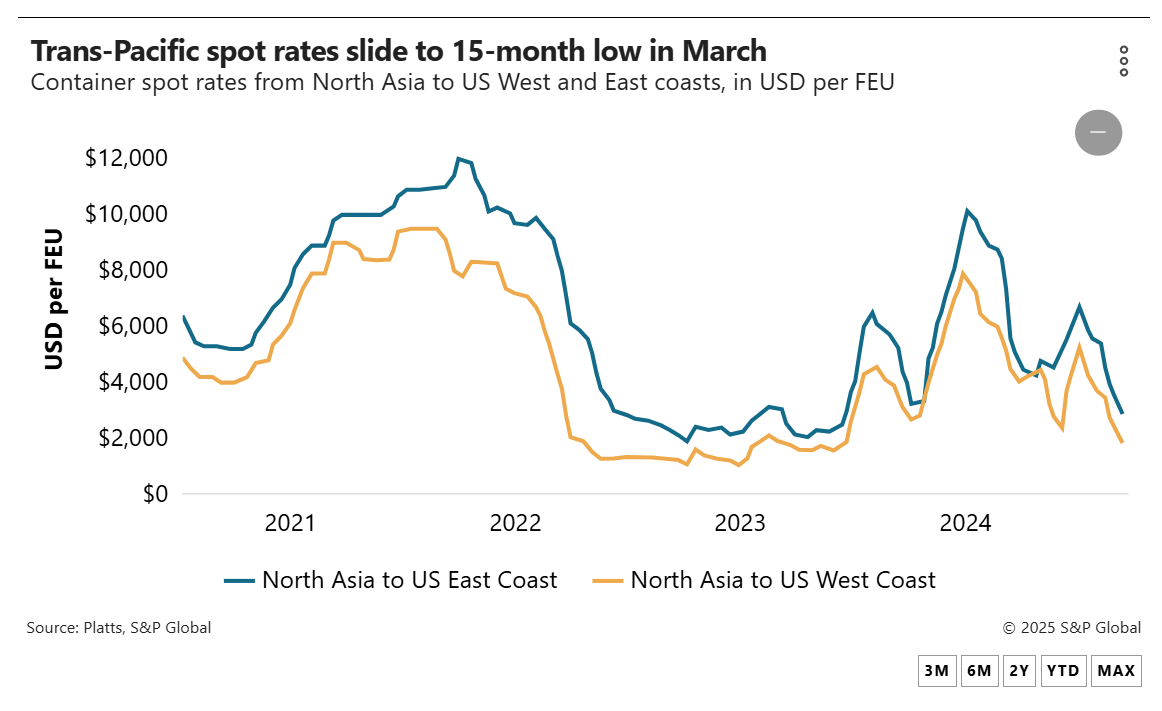

However, some shippers have resisted signing at higher rates this year because they believe the market will continue to soften in the second half, Caradonna said. Average spot rates from Asia to the US West Coast fell to $1,600 per FEU this week, down 69.5% from the first week of January and 48.7% year over year, according to Platts, sister company of the Journal of Commerce within S&P Global.

Other midsize importers are hesitant to make their MQCs right now due to demand uncertainty and confidence that the vessel space will be there when they need it, said Kurt McEloy, executive vice president at the forwarder Kerry Apex.

“It's hard for them to nail down their MQCs, so some midsize importers will wait until well into April,”McElroy said.

Stephen Nothdurft, vice president of North American sales at forwarder MOL Consolidation Service, said his clients likewise are not concerned about capacity constraints.

“Space is widely available,”he said.“There are some blanks, but it's hard to tell what is [due to] capacity management and what is downstream from service changes early this year.”

A midsize importer of home furnishings who asked not to be identified said he is operating under a“normal”timeline of wrapping up the first round of negotiations in March and signing the contract in April.

Several NVOs said carriers are also bringing different strategies to contract negotiations this year because of changes in the carrier alliances that took effect in February, with some pricing more aggressively in an effort to build market share.

The threat by the US Trade Representative (USTR) to levy charges as high as $1.5 million per port call by vessels built in China has some carriers that rely heavily on Chinese-built vessels concerned that customers will reduce their MQCs with them this year, so those lines are also quoting lower prices in order to retain business, NVOs said.