TTI Algeciras, one of the two main terminals in the west Mediterranean transshipment hub, has submitted expansion plans to the port authority that would increase handling capacity by 500,000 TEUs.

The €150 million ($177 million) investment by owners HMM and CMA CGM would take capacity at Spain's second-largest terminal to 2.1 million TEUs by 2028, with future plans to increase capacity to 2.8 million. In support of the investment, the Algeciras Port Authority has extended the terminal operating concession by 22 years to 2065.

“This expansion is the natural evolution of more than a decade of steady growth,”Alonso Luque, CEO of TTI Algeciras, said in a statement Wednesday.“The project not only adds much-needed physical capacity but also positions us to take on new service opportunities and larger vessels.”

HMM acquired 100% of TTI Algeciras in 2017 and sold a 49.9% stake to CMA CGM in 2020. The plan to expand TTI Algeciras is in line with the strategy of both carriers — more so CMA CGM — that are expanding investment in container terminals to diversify revenue and exert greater control over their supply chains.

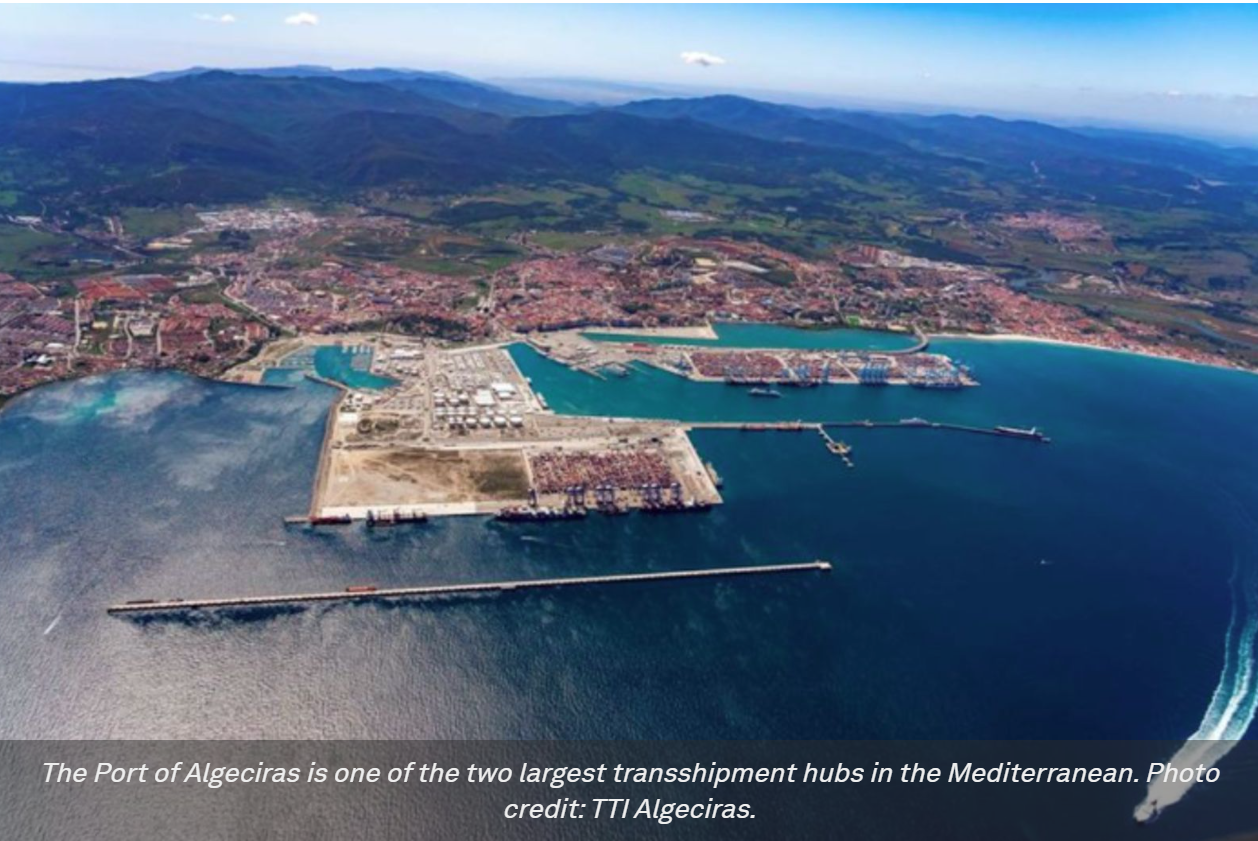

The Port of Algeciras is one of the two largest transshipment hubs in the Mediterranean and is situated in southern Spain just across the Strait of Gibraltar from its transshipment rival, the Moroccan port of Tanger Med.

Common-user terminal

Gerardo Landaluce, chairman of the Port Authority of the Bay of Algeciras, said TTI Algeciras has played a key role in boosting the international standing of the port.

“Its common-user model, open to multiple shipping lines and alliances, has helped position Algeciras as a global logistics platform and as a strategic tool for developing import and export flows throughout Andalusia and Spain,”Landaluce said in the statement.

Since Houthi militants began attacks on commercial shipping in the Red Sea in December 2023, carriers have been forced to divert around southern Africa. With two weeks added to the transit from Asia, carriers wanting faster turnaround times offloaded their megaships in Algeciras and Tanger Med for onward transshipment to destination ports inside the Mediterranean.

First-quarter volume at Algeciras tumbled 11% year over year because of congestion, operational challenges, declining transshipment volume and Maersk shifting an India-US service to Tanger Med. The port handled 4.7 million TEUs in 2024, down 0.6% from 2023.

APM Terminals Algeciras is the other primary terminal at Algeciras and Spain's largest.