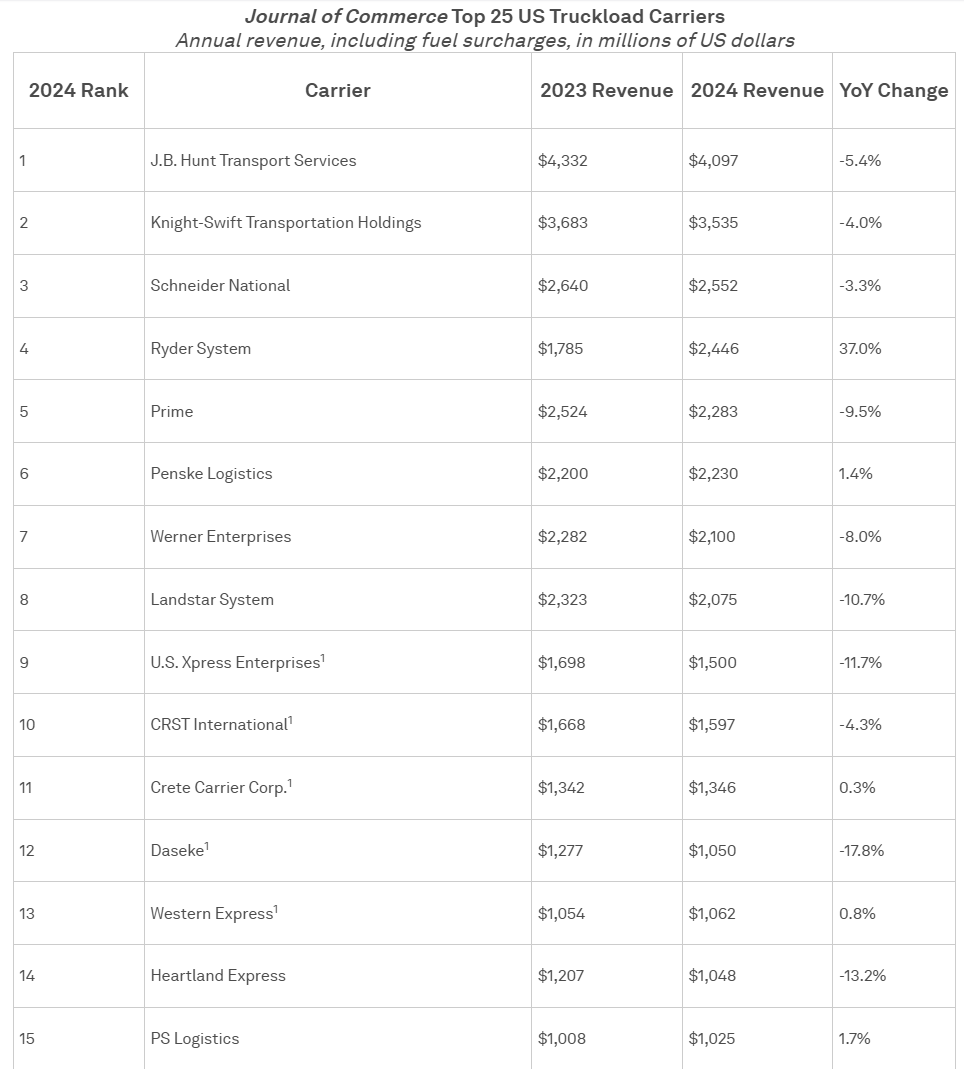

The 25 largest US truckload carriers cut their way through the second year of a cyclical freight downturn in 2024, with soft freight demand and low rates pushing their combined revenue down 3.9% year over year to $37.9 billion, according to the SJ Consulting Group/Journal of Commerce Top 25 US Truckload Carrier rankings.

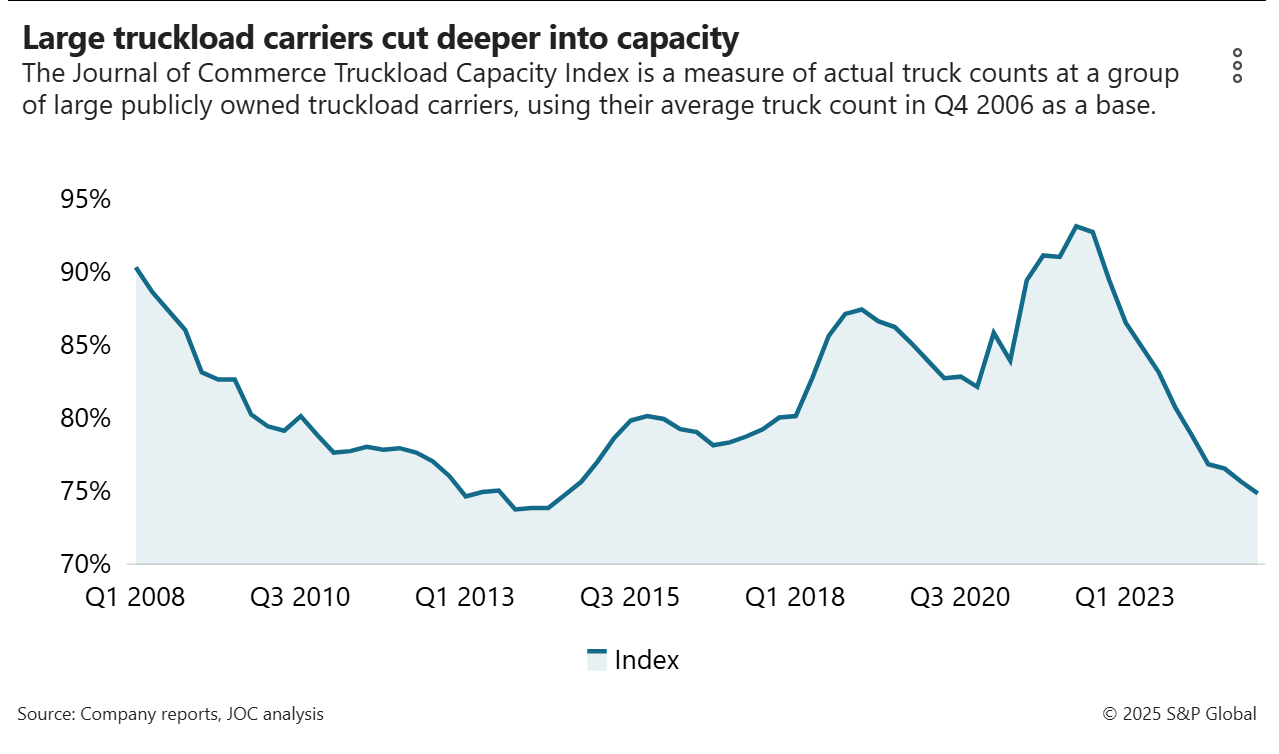

Excess capacity made it difficult for truckload carriers to gain traction in the market, except through acquisitions. The largest truckload carriers reduced their capacity throughout the year, parking or selling underutilized trucks and dropping the Journal of Commerce Truckload Capacity Index (TCI) to its lowest level in a decade.

Last year, revenue decreased at 17 of the Top 25 truckload carriers, an improvement compared with the 20 carriers in the rankings that lost revenue in 2023, according to SJ Consulting data. Since 2022, the Top 25 truckload carriers have lost 12.1% of their revenue, which hit $43 billion in that peak year of the COVID-19 pandemic boom.

This year isn't expected to bring much improvement for truckload carriers, large or small.

Heading into 2025, truckload executives were optimistic about the prospects for a rebound in demand and pricing. Nearly six months into the year, much of that optimism is gone.

“There's no sustained, steady demand coming this year,”said Jason Miller, the Eli Broad endowed professor of supply chain management at Michigan State University.

Surges in US imports did nothing to lift the truckload sector out of the doldrums in 2024, and they're not likely to do so in 2025, especially when the timing and extent of such surges shifts with the volatile trade policy of the Trump administration.

“Temporary spikes are not enough to change the market direction,”Miller told the Journal of Commerce.

Yet some believe the direction of the market is heading upward, albeit slowly. The latest RXO Curve forecast from logistics provider RXO noted that contract rates measured by the Cass Contract Rate Index turned positive year over year in the first quarter, rising 1.4%. Spot rates at RXO were up 9.1% year over year in the first quarter.

Even so, for spot or contract rates,“a steep ramp upwards is unlikely,”RXO said.

Highs and lows

The Top 25 truckload carriers in the rankings represent a small fraction of the total number of truckload carriers. There were 53,705 long-distance truckload carriers in operation across the US in 2022, according to the latest US Economic Census, a five-year census of businesses in the US and a benchmark for economic activity.

The census data, released in April, does not include one-truck owner-operators.

Only 248 of the 53,705 carriers in the US Economic Census had more than 250 employees. From 2017 through 2022 — the last two economic censuses — the overall number of truckload providers increased 68.3%. The number of truckload firms with more than 250 employees increased 12.2% with the addition of just 27 carriers in that period.

In that same five-year period, the number of firms with five employees or fewer increased by 70.1% to 26,941 companies. That reflects growth during the 2018 trucking boom and then the explosion of new carriers from 2020 through 2022.

The Top 25 truckload carriers, all companies with more than $500 million in annual revenue, may be outnumbered by small carriers, but they haul large volumes of freight for large shippers, making them almost a separate industry sector of their own.

The largest carriers in the rankings were J.B. Hunt Transport Services, with $4.1 billion in truckload-related revenue; Knight-Swift Transportation Holdings, with $3.5 billion; and Schneider National, with $2.6 billion, according to SJ Consulting Group research.

Last year was the second at the top of the rankings for those three companies, yet they each lost revenue compared with 2023. J.B. Hunt's truckload revenue dropped 5.4%; Knight-Swift's truckload revenue, excluding US Xpress Enterprises, dropped 4%; and Schneider's topline fell 3.3%, according to the data behind the rankings.

Ryder System climbed from eighth in the rankings to fourth place, increasing its truckload-related revenue 37% year over year. The increase does not represent Ryder's total revenue, which increased 7% last year, but its truckload-related revenue as defined by SJ Consulting Group. The acquisition of Cardinal Logistics in 2024 fueled that growth.

Multiyear strategic initiatives also are driving Ryder's growth, Robert E. Sanchez, chairman and CEO, told Wall Street analysts during a first-quarter earnings call in April.

“The key driver of expected earnings growth in 2025 is incremental benefits ... related to our contractual lease, dedicated, and supply chain businesses,”Sanchez said.

Ups and downs

In addition to Ryder, the Top 25 carriers that increased revenue last year included Covenant Transportation Group (6.6%), Stevens Transport (5%), Universal Truckload (3.9%) and PS Logistics (1.7%), according to SJ Consulting Group data.

An underlying lesson from Ryder is that diversification can be an effective strategy in dealing with a soft freight market and cautious customers. Many of the truckload carriers in the Top 25 rankings are pursuing more dedicated business rather than one-way truckload, or even, in the case of Knight-Swift, breaking into the less-than-truckload (LTL) market.

The company that lost the most in terms of revenue was Daseke, a specialized heavy-haul conglomerate owned by TFI International.

Daseke's revenue dropped 17.8% year over year to $1.1 billion, according to SJ Consulting Group, which attributed the decline to lower demand for infrastructure and industrial project work for specialized trucking.

However, Daseke retained its position as the 12th largest carrier in the rankings, a sign of how much revenue the overall market and the Top 25 group lost in 2024.

The 17 carriers that lost revenue in 2024 saw that revenue drop 9% on average in 2024. Still, the combined revenue of the Top 25 truckload carriers was higher than in any year before 2022. From 2020 through 2022, that combined revenue shot up 38.7% and then dropped 12.1% through 2024.

Altogether, nine carriers moved lower in the rankings last year, while six moved higher, and seven retained their rankings.

Three new companies joined or rejoined the Top 25: Covenant Transportation Group, Universal Truckload and Anderson Trucking Services.

The base level of revenue needed to get into the rankings fell from $722 million in 2023 to $565 million last year, a 21.8% decline. That's an indicator of the depth of the demand-driven malaise in the truckload market.